Dive in to the Quality Automotive Services Market! The automotive service industry stands at a pivotal juncture in 2024, driven by unprecedented technological transformation, evolving consumer expectations, and significant structural shifts in vehicle ownership patterns.

This comprehensive analysis examines market dynamics, financial performance, competitive landscapes, and emerging trends that define the quality automotive services sector.

The Value of Quality Automotive Services

Owning a vehicle means more than just driving—it also requires consistent care to ensure safety, performance, and longevity. That’s where quality automotive services play a critical role. A reliable automotive service center doesn’t just handle routine oil changes or tire rotations; it offers advanced diagnostics, factory-recommended maintenance, and specialized repairs that keep modern vehicles running at their best.

One example is Quality Plus Automotive Services, which has become a trusted name by combining technical expertise with customer-centered care. Their certified technicians use state-of-the-art equipment to identify potential issues early, whether it’s engine performance, transmission reliability, or electrical system health. This proactive approach reduces the likelihood of unexpected breakdowns and helps extend the lifespan of each vehicle.

At Quality Plus Automotive Service Inc, the commitment goes beyond mechanical work. They focus on precision in every step—performing detailed inspections, following manufacturer guidelines, and using high-quality replacement parts. Customers benefit from transparent communication, clear cost estimates, and service recommendations that prioritize both safety and value.

When you choose a provider like Quality Automotive Services, you’re not just fixing immediate problems—you’re investing in preventative care, improved fuel efficiency, and long-term reliability. It’s about creating confidence on the road, knowing your car is supported by professionals who combine technical knowledge with genuine customer care.

Global Market Overview and Growth Trajectory

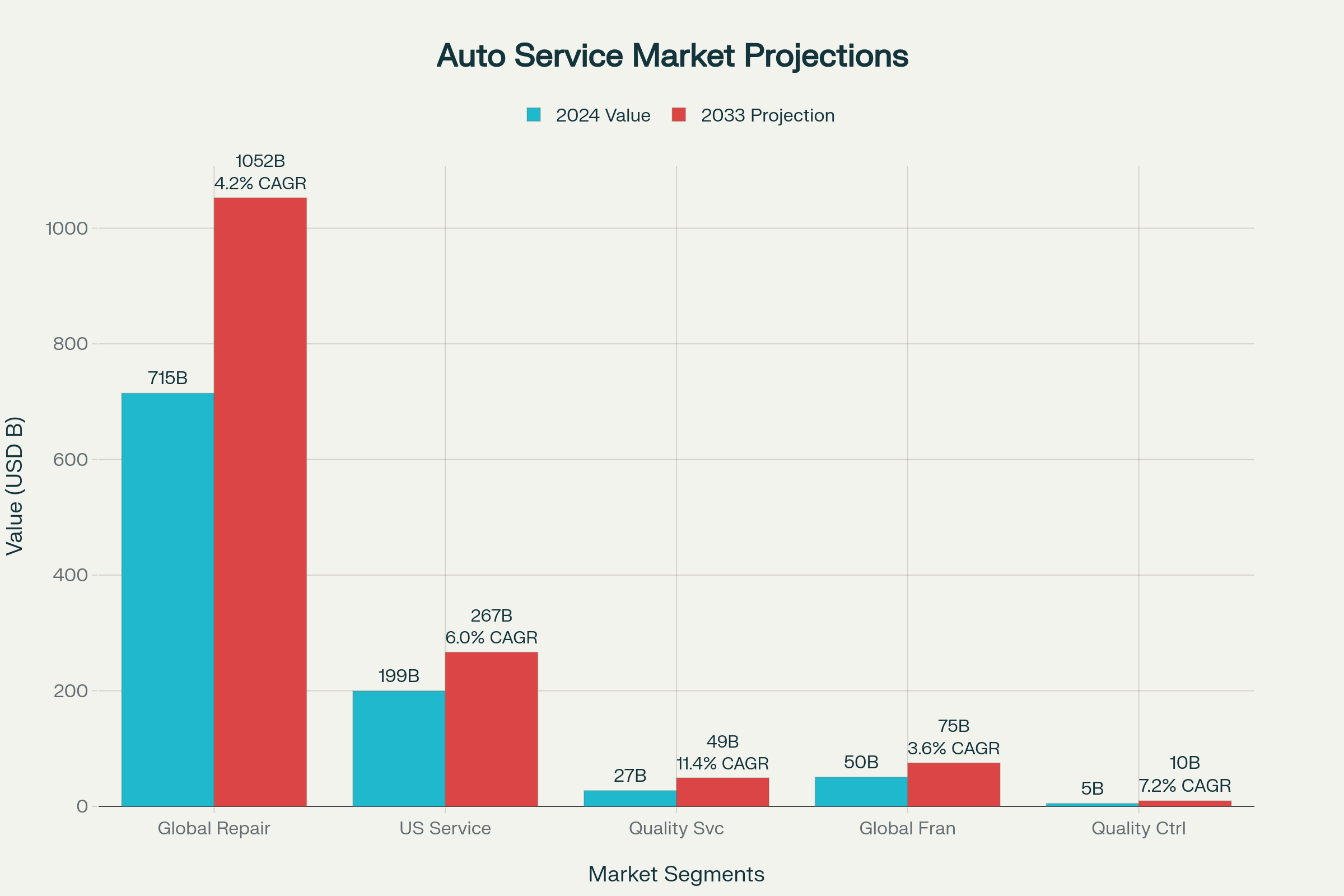

The global automotive repair and service market has demonstrated remarkable resilience and growth, reaching USD 714.51 billion in 2024 and projected to expand to USD 1,052.50 billion by 2033, representing a compound annual growth rate (CAGR) of 4.18%. This substantial market size reflects the critical role automotive services play in maintaining the world’s expanding vehicle fleet.

👉 Get our in-depth IT communication guide now—Free to download.

The US automotive service market specifically represents a significant portion of this global landscape, valued at USD 199.38 billion in 2026 with projections to reach USD 266.56 billion by 2030, demonstrating a robust 5.98% CAGR.

The American market’s strength derives from several key factors, including an aging vehicle fleet averaging 12.8 years in 2024—a record high that drives increased maintenance and repair demand.

Market size projections across different automotive service segments showing significant growth opportunities, particularly in quality services with an 11.41% CAGR

The automotive quality service segment shows particularly strong growth momentum, valued at USD 27.30 billion in 2024 and expected to reach USD 49.48 billion by 2032 with an impressive 11.41% CAGR. This growth reflects heightened consumer expectations for service excellence and the automotive industry’s emphasis on quality standards compliance.

Regional Market Distribution and Characteristics

The automotive service market exhibits distinct regional characteristics that reflect local economic conditions, regulatory environments, and consumer preferences.

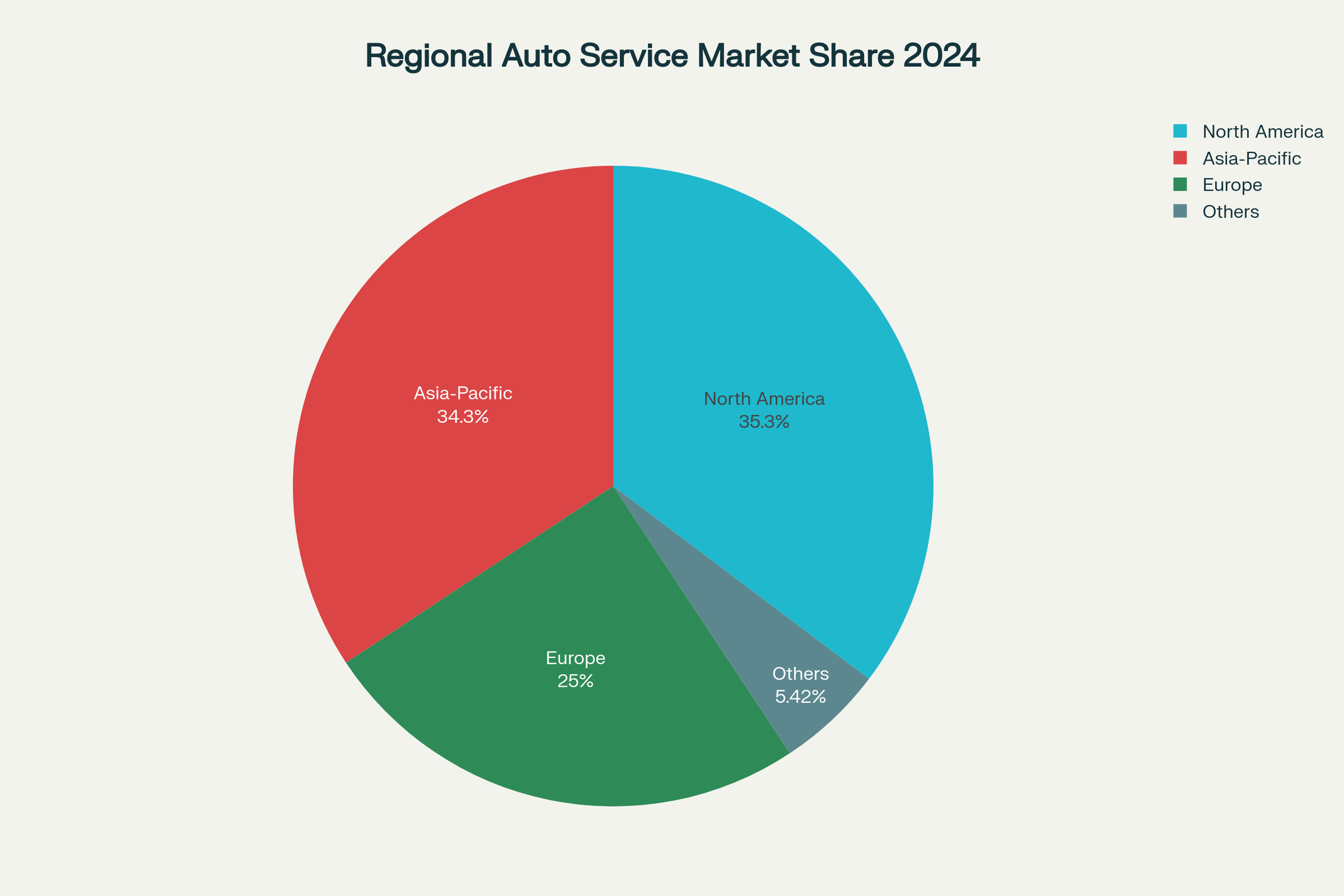

Regional distribution shows North America and Asia-Pacific dominating the automotive service market with nearly 70% combined market share in 2024

North America leads with 35.28% of the global market share, supported by high vehicle ownership rates, substantial disposable income, and a mature automotive infrastructure. The region benefits from a large installed vehicle base exceeding 292 million registered vehicles as of 2023, creating sustained demand for maintenance and repair services.

Contact HBLAB today for expert consultation on automotive software development.

Asia-Pacific follows closely with 34.3% market share and represents the fastest-growing region. This growth is driven by rapid automotive sales expansion, technological advancement adoption, and increasing urbanization in markets like China, India, and Southeast Asia. The region’s automotive production capabilities and growing middle class create substantial opportunities for service providers.

Europe accounts for 25% of the market, characterized by strong emphasis on environmental sustainability, electric vehicle adoption, and stringent regulatory standards. European markets demonstrate particular strength in premium automotive services and advanced technology integration.

Industry Structural Dynamics and Key Statistics

The automotive service industry operates within a complex ecosystem characterized by several critical dynamics:

Vehicle Fleet and Demographic Trends

The aging vehicle fleet represents a fundamental market driver. With the average vehicle age reaching 12.8 years in 2024—the highest on record—vehicles require more frequent and complex maintenance interventions.

This trend is particularly pronounced in developed markets where consumers extend vehicle ownership cycles due to improved reliability and economic considerations.

Vehicle registration data reveals over 292 million vehicles operating on US roads as of 2023, with new car sales reaching approximately 15.1 million units projected for 2024. The substantial installed base creates a stable foundation for ongoing service demand.

Labor Market Challenges and Opportunities

The automotive service industry faces significant workforce challenges that create both constraints and opportunities. Currently, 794,600 automotive technicians are employed in the United States, representing a 13% increase since pre-pandemic levels.

However, the industry confronts a critical shortage, with approximately 37,000 new technicians needed annually to meet demand, while only 39,000 graduates complete training programs each year.

This shortage has profound implications for service pricing, wait times, and competitive dynamics. The Bureau of Labor Statistics projects 67,800 average annual openings for automotive service technicians through 2033, with many positions arising from workforce turnover and retirement.

Market Segmentation and Service Types

The automotive service market segments into distinct categories based on service complexity and provider type:

Mechanical repair and maintenance dominates the market with 43.29% revenue share in 2024. This segment encompasses routine maintenance, engine services, brake systems, and transmission work—services that remain essential regardless of vehicle technology evolution.

Electrical and electronics services represent the fastest-growing segment with a projected 9.39% CAGR through 2030. This growth reflects the increasing complexity of vehicle electronics, advanced driver assistance systems (ADAS), and the proliferation of connected vehicle technologies.

Local garages maintain market leadership in the service provider segment, capturing significant market share due to accessibility, cost-effectiveness, and established customer relationships. Independent shops collectively handle approximately 75% of all repair work versus manufacturer dealerships.

Quality Standards and Industry Compliance

Quality management systems are the backbone of Quality Automotive Services, ensuring that every process, repair, and customer interaction meets internationally recognized benchmarks. One of the most critical frameworks is IATF 16949:2016, the global standard for automotive quality management.

This standard, which replaced ISO/TS 16949, emphasizes risk-based thinking, continuous improvement, and rigorous supply chain management. Today, more than 65,000 suppliers worldwide maintain certification to these standards, reinforcing trust and consistency across the industry.

The emphasis on Quality Automotive Services is not optional—it reflects major market drivers such as:

-

Stringent government regulations regarding vehicle safety and emissions

-

Rising consumer expectations for reliable service delivery

-

Globalization of automotive supply chains

-

Growing competition among professional service providers

To stay competitive, Quality Automotive Services must demonstrate compliance with multiple international standards including ISO 9001 for quality management, ISO 26262 for functional safety, and customer-specific requirements from global automakers. These frameworks ensure defect prevention, consistent performance, and continuous improvement across all levels of service operations.

Technology Transformation and Digital Innovation

The automotive sector is rapidly evolving, and Quality Automotive Services are being redefined by technological innovation. From AI to predictive maintenance, digital advancements are transforming how providers deliver reliable and customer-centric services.

Artificial Intelligence and Automation

AI-powered inspection tools allow Quality Automotive Services to complete detailed vehicle checks in under five minutes, while cutting costs by as much as 50%. Leading companies, such as Scope Technology in collaboration with Microsoft Azure, are pushing the boundaries of diagnostics to improve both accuracy and efficiency. Predictive maintenance solutions also leverage telematics data to anticipate repair needs before breakdowns occur.

This not only enhances customer satisfaction but also enables Quality Automotive Services providers to optimize scheduling, reduce downtime, and better manage parts inventory.

Digital Service Platforms

Digital booking platforms are a key enabler of Quality Automotive Services. By increasing booking conversion rates by up to 40%, these platforms streamline customer interactions, reduce administrative overhead, and make services more accessible. Mobile service options are also reshaping customer preferences, with 90% of consumers willing to accept mobile service appointments in dealer pilot programs.

This demonstrates how modern Quality Automotive Services must align with consumer demand for speed, convenience, and reliability.

Advanced Diagnostic Equipment

Modern vehicles require advanced diagnostic capabilities, making investment in specialized tools and training essential for Quality Automotive Services. For example, ADAS calibration is now mandatory for vehicles equipped with driver assistance systems. Service providers who prioritize advanced diagnostic tools, continuous software updates, and technician certifications ensure they remain competitive while delivering safe, high-quality outcomes.

Electric Vehicle Impact and Service Evolution

The global rise of electric vehicles is reshaping the landscape of Quality Automotive Services. EV sales grew by 35% year-over-year in 2023, with market share reaching 14% of all new automobile sales—up from 9% in 2021. This surge is not only altering service demand but also introducing new complexities into service delivery.

Electric vehicles transform the scope of Quality Automotive Services in several ways:

-

Reduced need for traditional maintenance due to fewer moving parts

-

Specialized service requirements for batteries, high-voltage systems, and charging infrastructure

-

New service revenue streams from battery diagnostics, software updates, and charging solutions

-

Ongoing training and certification for technicians handling high-voltage components

Service providers must balance the reduced frequency of conventional maintenance tasks with the increased complexity of EV systems. Success in this market requires continuous investment in technician education, specialized tools, and advanced processes that reinforce the value of Quality Automotive Services.

Performance Benchmarks and Operational Metrics

Industry performance varies significantly based on operational excellence and strategic focus. Research from PMA Benchmarking reveals key performance differentiators:

Top Performing Service Centers

Average monthly sales of $149,756 with 51.1% gross profit margins characterize top-performing automotive service centers. These facilities focus on quality service delivery, employee productivity optimization, and strategic resource management rather than simply maximizing volume.

Technician productivity among top performers runs approximately 50% higher than bottom-tier facilities. This productivity advantage stems from:

- Comprehensive employee training programs

- Efficient workflow processes

- Advanced diagnostic equipment

- Effective time management systems

Customer Satisfaction Metrics

Customer satisfaction scores across the automotive service industry average 80 points out of 100, with top-performing brands achieving 83 points. Subaru and Toyota lead mass-market satisfaction, while Mercedes-Benz and Tesla compete for luxury segment leadership.

Key satisfaction drivers include:

- Service quality consistency (84 points for driving performance and safety)

- Technology integration (80 points, +3% year-over-year improvement)

- Fuel efficiency services (80 points, +3% improvement)

- Transparent communication regarding service processes and costs

Financial Performance and Market Opportunities

The automotive service industry demonstrates strong financial fundamentals with significant growth opportunities:

Revenue and Profitability Trends

US light-duty automotive aftermarket sales reached $413.7 billion in 2024, representing 5.7% year-over-year growth. Including medium and heavy-duty vehicles, the entire US aftermarket projects to reach $664.3 billion by 2028 with a steady 5.1% CAGR.

Delayed maintenance represents a $36.2 billion opportunity in potential sales, indicating substantial untapped market potential for service providers who can effectively convert deferred maintenance into actual business.

Employment and Wage Trends

The automotive service industry employs more than 4.9 million people in the United States as of 2024. Technician wages average $24.15 per hour, representing nearly 4% annual growth over the past decade. This wage growth reflects both the value of skilled labor and the competitive pressure created by technician shortages.

Competitive Landscape and Market Consolidation

The automotive service market exhibits moderate fragmentation with ongoing consolidation activities. Major players include:

Leading Service Providers

National chains like Jiffy Lube International, Valvoline Instant Oil Change, and Firestone maintain significant market presence through franchising models and corporate locations. Recent consolidation examples include:

- Mavis Tires & Brakes’ pending acquisition of the 1,200-store Midas chain

- Valvoline’s $625 million purchase of Breeze Autocare

- Various private equity investments in multi-location operators

Independent Market Presence

Independent service providers retain substantial market share through localized service excellence, community relationships, and cost advantages. These providers benefit from:

- Lower overhead costs compared to national chains

- Personalized customer service capabilities

- Flexibility in service offerings and pricing

- Established local market knowledge

Technology-Driven Disruptors

Emerging service models blend technology with traditional service delivery:

- Cox Mobile Service coordinates remote repairs through AI dispatch systems

- Tesla’s direct service model integrates parts catalog access with digital service manuals

- Goodyear’s Fleet HQ surpassed 5 million service events through AI-optimized dispatch systems

Contact HBLAB today for expert consultation!

Market Challenges and Risk Factors

Despite strong growth prospects, the automotive service industry faces several significant challenges:

Workforce Development

The technician shortage represents the industry’s most critical challenge, with 31% of shops citing it as their primary concern. Contributing factors include:

- Aging workforce as baby boom generation technicians retire

- Limited program enrollment in automotive training programs

- Competition from other industries offering potentially higher compensation

- Negative perception of automotive service careers among younger workers

Technology Integration Costs

Advanced diagnostic equipment and training requirements create substantial capital investment needs. Service providers must continuously update:

- Diagnostic software and hardware systems

- ADAS calibration equipment

- EV service capabilities

- Technician certification and training

Regulatory Compliance

Increasing regulatory requirements around environmental protection, safety standards, and right-to-repair legislation create compliance costs and operational complexity. Service providers must navigate:

- EPA environmental regulations

- OSHA workplace safety requirements

- State-specific right-to-repair legislation

- OEM warranty compliance standards

Future Market Outlook and Strategic Implications

The automotive service industry outlook reflects both significant opportunities and strategic challenges:

Growth Drivers

Vehicle complexity continues increasing, driving demand for specialized service capabilities. Connected vehicles, autonomous driving systems, and electrification create new service categories while traditional mechanical services remain essential.

Subscription-based service models gain traction as consumers seek predictable costs and convenient service delivery. These models provide recurring revenue streams while improving customer retention.

Strategic Considerations

Service providers must balance several strategic priorities:

- Technology investment in diagnostic capabilities and digital platforms

- Workforce development through training programs and competitive compensation

- Service differentiation through quality excellence and customer experience

- Market positioning to capture growth in emerging service categories

The automotive service industry’s future success depends on adaptability to technological change while maintaining excellence in fundamental service delivery. Providers who successfully navigate workforce challenges, invest in appropriate technology, and maintain customer focus will be best positioned to capitalize on substantial growth opportunities in this evolving market.

HBLAB – Your Trusted Partner in Quality Automotive Software Solutions

In the rapidly evolving automotive service industry, technology integration has become essential for operational excellence and competitive advantage. HBLAB specializes in developing sophisticated automotive software solutions that directly support Quality Automotive Services, helping providers achieve greater efficiency, compliance, and customer satisfaction.

With over 630+ skilled professionals and 30% senior-level employees with extensive automotive technology experience, HBLAB delivers comprehensive solutions for automotive service management, diagnostic integration, and customer engagement platforms. Each of these solutions is carefully designed to strengthen the foundation of Quality Automotive Services while ensuring scalability and long-term reliability.

Our CMMI Level 3 certification further guarantees process excellence in developing mission-critical automotive applications that empower service providers to consistently deliver high-quality outcomes.

HBLAB’s automotive expertise extends to inventory management systems, predictive maintenance platforms, customer relationship management, and advanced diagnostic integration. These advanced tools are built to optimize service operations and elevate customer experiences, all while reinforcing the standards of Quality Automotive Services.

Our cost-effective development approach provides up to 30% savings compared to traditional development resources, ensuring affordability without compromising quality or reliability.

From large-scale automotive service franchises to independent repair shops, HBLAB enables digital transformation initiatives that place Quality Automotive Services at the center of operational growth. By improving technician productivity, streamlining workflows, and enhancing customer engagement, we help service providers build stronger competitive positions in the marketplace.

Our flexible engagement models also support diverse project requirements—ranging from end-to-end system development to specialized automotive software integration—ensuring that businesses of all sizes can access the benefits of advanced technology for Quality Automotive Services.

Summary: The Importance of Quality Automotive Services

The automotive service industry in 2024 is undergoing rapid transformation, driven by technological advancements, an aging vehicle fleet, and rising consumer expectations for Quality Automotive Services.

Valued at USD 714.51 billion globally, the market is projected to reach USD 1,052.50 billion by 2033, with the U.S. market alone expected to grow to USD 266.56 billion by 2030. Quality Automotive Services are critical to meeting these demands, offering advanced diagnostics, factory-standard maintenance, and specialized repairs to ensure vehicle safety, performance, and longevity.

Providers like Quality Plus Automotive Services exemplify excellence by leveraging certified technicians, state-of-the-art equipment, and customer-focused care to deliver reliable outcomes.

The integration of AI, predictive maintenance, and digital platforms enhances efficiency and customer satisfaction, reinforcing the value of Quality Automotive Services.

With a focus on compliance with standards like IATF 16949:2016 and investments in EV and ADAS capabilities, Quality Automotive Services providers are well-positioned to capitalize on market growth while addressing challenges like technician shortages and regulatory complexities.

People Also Ask: Quality Automotive Services

1. Who owns Quality Automotive Services?

Quality Automotive Services is a term widely used in the industry to describe professional service providers that maintain high standards of vehicle repair, diagnostics, and customer care. While there are many independent businesses globally that brand themselves around Quality Automotive Services, ownership varies by location and company structure. Typically, such providers are locally owned repair shops, automotive service franchises, or technology-driven companies offering certified service solutions.

2. What is quality in automotive?

Quality in the automotive sector refers to consistent, reliable, and safe performance across manufacturing, servicing, and repair. For Quality Automotive Services, quality means adhering to international standards such as ISO 9001, IATF 16949, and OEM specifications. It involves defect prevention, timely delivery, customer satisfaction, and continuous improvement. In practice, Quality Automotive Services are those that combine technical expertise with advanced diagnostic tools, ensuring vehicles operate safely and efficiently.

3. What is the revenue of Quality Automotive Services?

The global market for Quality Automotive Services generates billions annually, reflecting rising consumer demand for reliable maintenance, repair, and digital service solutions. Market revenue continues to grow as more customers prioritize certified, technology-enabled service providers. While revenues differ by company size and region, service franchises and independent workshops offering Quality Automotive Services are seeing significant gains due to electric vehicle adoption, AI-powered diagnostics, and predictive maintenance trends.

4. Are Valvoline employees ASE certified?

Yes, many Valvoline service centers employ ASE-certified technicians. ASE (Automotive Service Excellence) certification is a widely recognized credential that validates the expertise of professionals delivering Quality Automotive Services. Certification ensures that technicians have the knowledge and practical skills needed to maintain vehicles safely, which strengthens customer trust in the quality of service provided.

5. Who owns A2Mac1?

A2Mac1, a leading automotive benchmarking and data analytics company, operates independently but partners with automakers and service providers worldwide. While it is not directly tied to Quality Automotive Services, its insights into vehicle performance and design indirectly support service providers in delivering higher-quality maintenance and repair solutions.

6. Who owns which automotive brands?

The ownership of automotive brands is diverse and global. Major players such as Volkswagen Group, Toyota Motor Corporation, Stellantis, and Hyundai Motor Group own multiple car brands. For businesses offering Quality Automotive Services, knowledge of brand ownership is important, as it affects access to OEM parts, repair standards, and service protocols across different vehicles.

7. Who is the biggest automotive manufacturer?

Currently, Toyota holds the position as one of the world’s largest automotive manufacturers by volume. This matters to Quality Automotive Services providers because global leaders like Toyota set benchmarks for manufacturing quality, safety, and after-sales support, which influence service practices worldwide.

8. Does China own any car brands?

Yes, China owns several major car brands including Geely, BYD, NIO, and SAIC Motor. As Chinese brands expand globally, Quality Automotive Services providers must adapt to new technologies, electric vehicle platforms, and diagnostic requirements to effectively service these vehicles.

9. Who owns Isuzu?

Isuzu Motors Ltd. is a Japanese company that operates independently, though it has had past collaborations with global manufacturers like General Motors. For Quality Automotive Services, understanding the background of brands like Isuzu ensures proper maintenance, use of genuine parts, and adherence to OEM service guidelines.

10. Did Toyota buy Isuzu?

Toyota holds a minority stake in Isuzu but has not fully acquired the company. This strategic relationship supports cooperation in diesel engine technology and commercial vehicles. Quality Automotive Services providers benefit from such partnerships, as collaboration among automakers often results in better service documentation and technology sharing.

11. Who owns Mazda?

Mazda remains an independent Japanese automaker, though it maintains strategic partnerships with Toyota. For Quality Automotive Services, servicing Mazda vehicles requires specialized diagnostic knowledge and adherence to Japanese automotive quality standards, which highlight precision and reliability.

11. Which is better, Hilux or DMAX?

The Toyota Hilux and Isuzu D-MAX are both popular pickup trucks known for durability and performance. The choice depends on driver preference, intended use, and regional service support. Providers of Quality Automotive Services ensure that both vehicles receive optimal maintenance, offering expert diagnostics, regular servicing, and genuine parts replacement to keep performance at its best.

CONTACT US FOR A FREE CONSULTATION

READ MORE:

– Ignite Business Growth: Mastering Advanced Distribution Management system

– Digital Workplace Transformation: The Definitive Future of Work

– Agentic AI In-Depth Report: The Most Comprehensive Business Blueprint