The global IT security companies market is projected to exceed $300 billion by 2026, with an expected compound annual growth rate of 11.9% through 2033.

This explosive growth reflects the urgent need for organizations worldwide to protect their digital assets against AI-driven attacks, ransomware, and identity-based breaches. Enterprise-grade security has become a fundamental business requirement, driving consolidation among IT security companies.

Traditional security models have become obsolete as cloud adoption, remote work, and IoT devices expand the attack surface. IT security companies are responding with:

- Zero-trust architectures that verify every access request

- AI-powered threat intelligence for real-time detection

- Unified platforms that eliminate security silos

The largest IT security companies now command valuations that rival traditional enterprise software providers.

The Global Cybersecurity Landscape in 2026

Cybersecurity has moved from technical departments to executive boardrooms and investor portfolios. The market’s evolution reflects three forces: accelerating digital transformation, regulatory pressure from major breaches, and autonomous AI systems capable of both attacking and defending.

Market research firms show different 2026 valuations: Forrester projects $200 billion, Gartner estimates $240 billion, and Cybersecurity Ventures predicts $522 billion in total security spending.

The market is experiencing double-digit growth driven by:

- Regulatory mandates requiring enterprise-grade security in healthcare, finance, and government

- Insurance companies demanding security standards before coverage

- The need to embed security into AI development and cloud infrastructure

A tier of elite platforms valued between $50 billion and $131 billion has emerged. The five largest IT security companies by market cap collectively command approximately $360 billion in market value.

This premium reflects proven platforms, large customer bases, and recurring revenue models.

Ranking Criteria for IT Security Companies

Ranking the world’s leading IT security companies requires evaluating multiple dimensions that capture market dominance and strategic positioning.

Market Capitalization and Financial Strength

Market cap reflects investor confidence in a company’s long-term position and ability to monetize technology. A company valued at $60 billion generating $6.5 billion in annual recurring revenue shows different characteristics than one with $1.8 billion in revenue.

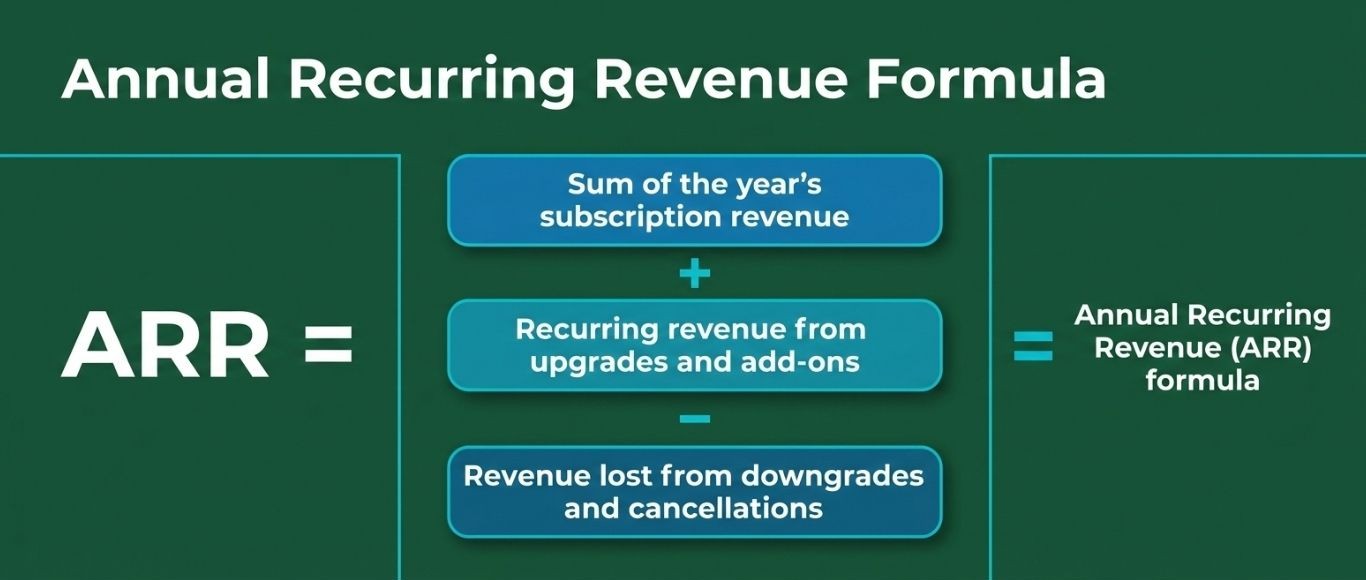

Subscription Revenue and Annual Recurring Revenue (ARR)

ARR is the primary health metric for IT security companies. Subscription models provide:

- Predictable cash flow

- Strong customer retention

- Scalability without proportional cost increases

CrowdStrike’s ARR of $4.92 billion, growing 23% year-over-year, shows the market’s shift toward unified platforms.

Product Innovation and Technology

AI-driven threat detection has become the main innovation focus. Palo Alto Networks reported approximately $545 million in ARR from AI products in Q4 fiscal 2025, a 2.5-fold increase year-over-year.

Artificial intelligence will define competitive advantage in security operations for the next decade.

Enterprise Customer Base

- Palo Alto Networks has 80,000+ enterprise customers, including three-fourths of the Global 2000

- CrowdStrike serves 29,000+ enterprise customers and handles 500 billion transactions daily

- Cloudflare protects 20%+ of all websites globally

Service Excellence and Support

Companies offering 24/7 managed detection and response, threat hunting, and incident response command premium pricing by reducing customer burden and shortening response time.

Industry Recognition

Gartner’s Magic Quadrant, Forrester Wave, and MITRE ATT&CK evaluations provide validation that customers use when evaluating vendors.

Top 10 Global IT Security Companies in 2026

1. Palo Alto Networks (PANW)

Market Cap: $130.8 billion | Annual Revenue: $9.55 billion | Founded: 2005 | Headquarters: Santa Clara, California

Palo Alto Networks is the world’s largest pure-play cybersecurity company. The company transformed from a firewall vendor into a complete security operating system through strategic acquisitions.

Core Specializations:

- Network security and next-generation firewalls

- Cloud security and SASE

- Security operations (Cortex XDR)

What Sets Them Apart: Next-generation security ARR reached $5.6 billion, while AI-related ARR exceeded $545 million. The company operates in 150 countries and serves 80,000+ enterprise customers, dominating complex hybrid and multi-cloud environments.

2. CrowdStrike (CRWD)

Market Cap: $115 billion | Annual Revenue: $4.57 billion (TTM) | Founded: 2011 | Headquarters: Austin, Texas

CrowdStrike is the dominant player in cloud-native endpoint security and extended detection through its lightweight Falcon platform and threat intelligence.

Core Specializations:

- Endpoint protection and EDR/XDR

- Cloud workload security

- Identity threat detection

What Sets Them Apart: Q3 fiscal 2026 revenue reached $1.23 billion (22% YoY growth) with net new ARR of $265 million (73% YoY growth). Subscription gross margin of 78-81% shows strong pricing power. The single agent, multi-module approach delivers comprehensive security through one unified console.

3. Cloudflare (NET)

Market Cap: $64.5 billion | Annual Revenue: $2.01 billion | Founded: 2009 | Headquarters: San Francisco, California

Cloudflare has grown from a content delivery network into a critical provider of edge security, DDoS protection, and zero-trust access for distributed workforces.

Core Specializations:

- Edge security and DDoS protection

- Zero-trust network access

- Web application firewall (WAF)

What Sets Them Apart: Operating edge infrastructure in 300+ cities globally lets Cloudflare inspect traffic closer to endpoints than competitors using centralized data centers. Revenue growth of 27% year-over-year with EBITDA margins near 22% demonstrates scalability.

4. Fortinet (FTNT)

Market Cap: $56-60 billion | Annual Revenue: $6.55 billion | Founded: 2000 | Headquarters: Sunnyvale, California

Fortinet maintains strong position through its FortiGate next-generation firewall and expanding SASE portfolio.

Core Specializations:

- Next-generation firewalls

- Network security

- Secure access service edge (SASE)

What Sets Them Apart: The company’s 13,500 employees and international network reflect decades of customer-focused service. Revenue growth of 10% year-over-year with gross margins above 75% shows steady execution. Fortinet is the dominant vendor in enterprise firewalls.

5. Zscaler (ZS)

Market Cap: $36.9 billion | Annual Revenue: $2.83 billion | Founded: 2007 | Headquarters: San Jose, California

Zscaler represents cloud-native security that prioritizes modern architecture over legacy perimeter defense.

Core Specializations:

- Cloud-native zero-trust platform

- Secure web gateway

- Data loss prevention

What Sets Them Apart: The zero-trust platform processes 500 billion transactions daily. ARR growth of 26% year-over-year with free cash flow margins exceeding 50% reflects strong economics. Zscaler serves 45%+ of Fortune 500 companies and 40% of Global 2000 organizations.

6. Check Point Software Technologies (CHKP)

Market Cap: $20 billion | Annual Revenue: $2.60 billion | Founded: 1993 | Headquarters: Tel Aviv, Israel

Check Point is a foundational provider of network security and threat prevention, though 6% growth reflects challenges from cloud-native competitors.

Core Specializations:

- Network security firewalls

- Threat prevention

- Infinity Platform with hybrid mesh architecture

What Sets Them Apart: Security subscription revenues at 43% of total revenue continue growing at double-digit rates. Presence in 88 countries with telecom and government relationships shows deep positioning. Gross profit margins of 85%+ and operating margins of 40%+ demonstrate strong financial discipline.

7. CyberArk Software (CYBR)

Market Cap: $23 billion | Annual Revenue: $1.30 billion | Founded: 1999 | Headquarters: Newton, Massachusetts

CyberArk has dominant position in privileged identity management based on the understanding that enterprise security pivots on identity and access controls.

Core Specializations:

- Privileged access management (PAM)

- Identity security

- Secrets management

What Sets Them Apart: ARR of $1.341 billion growing 45% year-over-year shows aggressive expansion. Subscription ARR reached $1.158 billion with 57% YoY growth, indicating rapid cloud adoption. International presence in 110 countries reflects positioning as the primary reference for zero-trust identity frameworks.

8. Okta (OKTA)

Market Cap: $16 billion | Annual Revenue: $2.6-2.9 billion | Founded: 2009 | Headquarters: San Francisco, California

Okta provides the foundational identity layer for modern security through directory services, single sign-on, multi-factor authentication, and identity lifecycle management.

Core Specializations:

- Identity and access management (IAM)

- Single sign-on (SSO)

- Multi-factor authentication (MFA)

What Sets Them Apart: Q3 fiscal 2026 revenue of $742 million growing 12% YoY shows steady execution. Okta AI for Agents addresses machine identity and AI workload authentication. Remaining performance obligations of $4.292 billion indicate strong future revenue visibility.

9. Cisco Systems (Security Division)

Market Cap: Part of $242 billion parent | Security Revenue: $1.98 billion | Founded: 1984 | Headquarters: San Jose, California

Cisco’s security division provides network infrastructure security, endpoint protection, and security operations through firewalls, threat protection, identity services, and the Splunk analytics platform.

Core Specializations:

- Network security

- Threat protection

- Security analytics (via Splunk acquisition)

What Sets Them Apart: Security revenue of $1.98 billion declined 2% YoY in Q1 fiscal 2026 as customers shift from on-premises to cloud-native models. The Splunk acquisition in 2023 showed major commitment to security operations and threat intelligence.

10. IBM Security (Business Unit)

Market Cap: Component of $234 billion parent | Parent Company Founded: 1911 | Headquarters: Armonk, New York

IBM Security provides managed security services, threat intelligence, identity management, and data protection.

Core Specializations:

- Managed security services

- Threat intelligence

- Data protection

What Sets Them Apart: While IBM doesn’t report security revenue separately, the business unit holds critical positions in government and financial services where IBM maintains deep relationships. Focus on AI-powered security operations, zero-trust identity, and managed detection positions IBM as a critical provider for large regulated enterprises.

Notable IT Security Companies

Beyond the top 10 product vendors, management and consulting firms provide essential security operations outsourcing and professional services.

Arctic Wolf, based in Eden Prairie, Minnesota, dominates managed detection and response with a cloud-native platform analyzing 330 trillion daily security observations across 10,000+ organizations.

Deloitte leads global professional services for cybersecurity consulting, threat detection, and incident response. Accenture Security provides comprehensive managed services including threat hunting, vulnerability management, and compliance verification. Secureworks offers managed detection, threat intelligence, and incident response for mid-market and large enterprises.

Service providers operate differently from product vendors—they monetize labor and expertise rather than software licenses, generating recurring revenue through managed service agreements with gross margins of 45-60% compared to 75-85% for software vendors.

For comprehensive coverage of Australian cybersecurity companies, see The Australian Cybersecurity Companies ranking.

Specialization Within IT Security Companies

The IT security companies market has stratified by technical specialization and customer segment.

- Network Security and Perimeter Defense

- Endpoint Protection and Extended Detection

- Cloud Security and Container Protection

- Identity and Access Management

- Security Operations and Managed Detection

Career Prospects and Compensation in IT Security Companies

The cybersecurity industry offers exceptional career progression and pay compared to general IT roles.

Entry-Level Positions

Security Analyst, SOC Analyst, Junior Security Engineer

Typical salary: $70,000 to $105,000 annually

Major companies like Palo Alto Networks, CrowdStrike, and Cloudflare offer entry-level packages near $100,000, including base salary, signing bonuses, and equity.

Mid-Level Positions

Security Engineer, Incident Responder, Security Consultant

Typical salary: $100,000 to $150,000 annually

Professionals with specialized expertise in cloud security or threat hunting earn up to $160,000 plus equity. Those with enterprise relationships command consulting fees of $200-$300 per hour.

Senior-Level Positions

Security Architect, Principal Security Engineer, Security Manager

Typical salary: $130,000 to $190,000 annually plus equity grants

Professionals with 10+ years experience in AI-driven threat detection, zero-trust architecture, or quantum-safe cryptography often earn $200,000 to $250,000 annually.

Executive Positions

Chief Information Security Officer (CISO)

Typical salary: $160,000 to $300,000+ annually plus performance incentives and equity

Master’s degree holders from top programs earn median salaries of $200,000, with high-performers exceeding $214,000.

Can You Make $200,000+ in Cybersecurity?

Yes—senior positions, specialized technical roles, and CISO positions routinely exceed this threshold. The skills shortage drives aggressive recruitment, rapid advancement, and exceptional compensation for high-performers.

Best IT Security Companies to Work For

Palo Alto Networks, CrowdStrike, Cloudflare, and Fortinet show consistent Glassdoor ratings of 3.8 to 4.4 stars, indicating strong satisfaction with pay, benefits, professional development, and work-life balance.

About HBLAB

HBLAB is a long term software development and IT augmentation partner for organizations that need to ship digital products while meeting modern security expectations such as secure coding, cloud hardening, and resilient operations.

With 10 plus years of experience and a team of 650 plus professionals, HBLAB can support security sensitive roadmaps through scalable delivery, reliable engineering processes, and senior talent aligned to complex enterprise requirements.

HBLAB holds CMMI Level 3 certification, which helps teams maintain consistent quality controls and predictable delivery outcomes across distributed engagements.

The company has been building AI powered solutions since 2017, a practical advantage for security oriented use cases like anomaly detection, log analytics, and automation that reduces operational load.

Engagement models are flexible across offshore, onsite, and dedicated teams, helping enterprises extend capacity quickly while keeping costs efficient, often around 30 percent lower cost compared with traditional local hiring.

👉 Looking to accelerate a product or platform while strengthening enterprise grade security practices across the SDLC?

CONTACT US FOR A FREE CONSULTATION

FAQ

1. Who are the Big 4 in Cybersecurity?

The “Big 4” traditionally meant professional services firms: Deloitte, PwC, EY, and KPMG. In product categories, the Big 4 pure-play vendors are:

- Palo Alto Networks (undisputed market leader)

- CrowdStrike (dominating endpoint security)

- Cloudflare (dominating edge security)

- Zscaler or Fortinet (depending on category)

Palo Alto Networks and CrowdStrike have created a two-tier market where these vendors capture the majority of enterprise security budgets.

2. How Much Does It Cost to Start a Security Company?

Starting a managed security services firm requires $115,000 to $310,000 in initial capital:

- Office setup: $20,000-$50,000

- Security hardware and lab equipment: $25,000-$60,000

- Software licenses: $15,000-$45,000

- Certifications and training: $10,000-$30,000

- Legal/compliance setup: $10,000-$25,000

A sophisticated consulting or managed detection firm needs $250,000 in upfront costs plus $395,000+ in annual payroll.

Total cash requirement to reach profitability: $400,000 to $750,000. Successful vendors achieve profitability in 18-36 months with consistent customer acquisition.

3. What Makes IT Security Companies Suitable for Fintech?

Fintech companies need IT security companies with:

- Deep regulatory compliance expertise (PCI DSS, SOC 2, ISO 27001)

- Comprehensive audit capabilities for regulators

- Financial crime and fraud detection incident response

Palo Alto Networks and CrowdStrike provide FedRAMP authorization and NSA-CIRA certification for government and regulated institutions. These vendors embed security and compliance frameworks into their platforms, enabling automated compliance reporting.

READ MORE:

– Will Cybersecurity Be Replaced by AI? Bold Trends Shaping Jobs in 2026

– Machine Learning and Cyber Security: A Complete 2026 Guide for Modern Enterprises