Explore IT outsourcing trends driving 2026 growth, from AI and cybersecurity to nearshoring strategies. Learn why global enterprises are reshaping their sourcing strategies for competitive advantage.

Why 2026 Marks a Turning Point for IT Outsourcing Trends

The IT outsourcing market stands at an inflection point. For decades, outsourcing was primarily a cost mitigation play: organizations hired teams overseas to reduce labor expenses while maintaining operational continuity.

By 2026, outsourcing has become something far more strategic: a lever for innovation, agility, and competitive advantage in an AI driven economy. These IT outsourcing trends reflect fundamental shifts in how enterprises approach technology partnerships.

Several macro forces converge to make this moment distinctive. Digital transformation has moved from defensive necessity (pandemic driven remote work) to offensive opportunity (AI powered business redesign). Simultaneously, talent shortages in developed markets have grown acute.

The World Economic Forum estimates a global shortage of millions of skilled IT professionals, particularly in emerging areas like artificial intelligence, cybersecurity, and cloud architecture. Companies cannot hire fast enough internally; outsourcing fills that gap.

At the same time, geopolitical tensions including trade tariffs, data localization laws, and supply chain vulnerabilities have pushed organizations to diversify their sourcing footprint beyond traditional low cost hubs. These IT outsourcing trends toward diversification reshape the global delivery map.

Perhaps most significantly, the business value of outsourcing has shifted from labor arbitrage to strategic partnership. Rather than outsourcing routine support work (helpdesk, basic coding), enterprises now outsource the most critical functions: AI model development, cloud architecture design, and advanced cybersecurity operations.

Contracts are moving away from hourly billing toward outcome based models, where vendors are paid for measurable results: faster deployments, higher application quality, lower security incidents, not merely hours logged.

The paradox of 2026 is that while enterprises are spending more on IT outsourcing than ever, they are also far more selective about partners, demanding not just cost savings (15 to 30% reduction is table stakes) but proof of innovation capability, governance maturity, and long term value creation.

Global IT Outsourcing Market Landscape

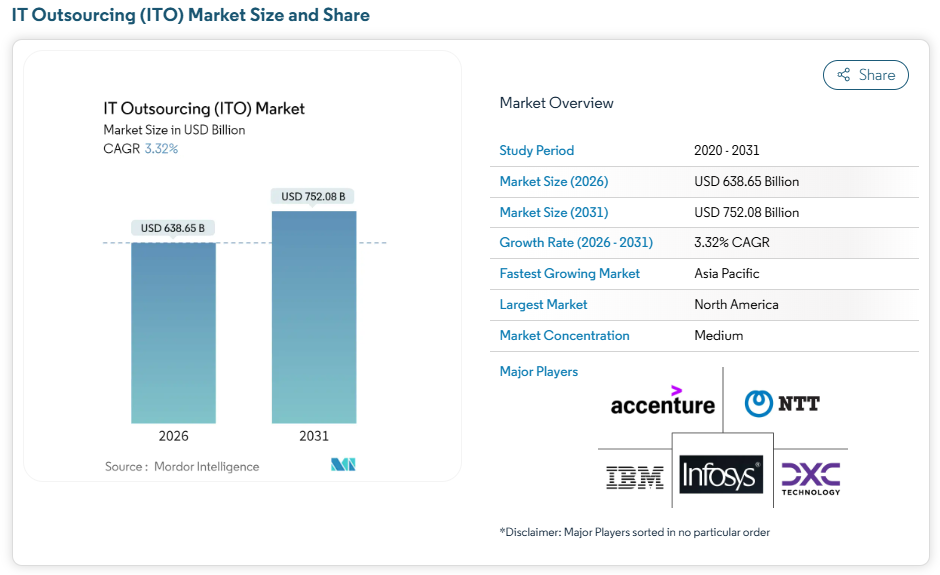

The numbers tell a compelling story of sustained expansion. The global IT outsourcing market is estimated at approximately $638.65 billion in 2026 and is projected to reach $752.08 billion by 2031, growing at a CAGR of 3.32%.

Enterprise Adoption

Approximately 92% of Global 2000 companies maintain active IT outsourcing contracts, demonstrating that this is no longer a niche practice but a standard operating model. For these enterprises, the question is not whether to outsource, but what to outsource and to whom—a strategic consideration shaped by evolving IT outsourcing trends.

Cost Benefits

Empirical research shows that IT outsourcing can deliver 15 to 30% cost savings on average, with some functions like helpdesk support reaching 91% success rates in cost reduction. However, a Computer Economics survey found that roughly 75% of outsourcing agreements achieve their cost goals, meaning one quarter do not, highlighting that cost reduction requires sophisticated vendor management and clear governance.

The shift is toward total cost of ownership (TCO) optimization rather than simple labor cost reduction.

Growth Drivers

Market expansion is propelled by AI and machine learning services (the fastest growing segment), cloud migration and multi cloud management, cybersecurity and compliance outsourcing, and advanced data analytics. Traditional staff augmentation and basic IT support remain significant but are growing slower than these emerging service lines.

Value Driven Contracting

Instead of fixed cost or hourly outsourcing models, enterprises increasingly negotiate outcome based contracts, paying vendors based on performance metrics (uptime percentage, deployment velocity, security incident resolution time) rather than resources deployed. This contracting evolution represents one of the most significant IT outsourcing trends affecting vendor relationships.

Build operate transfer (BOT) models and dedicated offshore development centers (ODCs) are becoming standard, allowing clients to scale teams rapidly while sharing risk with the outsourcing partner.

Geopolitical Factors

Data localization laws (particularly in Europe, India, and Vietnam), trade tensions, and supply chain resilience concerns have prompted enterprises to diversify suppliers across multiple geographies. Understanding these geopolitical IT outsourcing trends is critical for risk management.

Nearshoring, sourcing from countries within the same region, is gaining traction as a way to balance cost savings with reduced supply chain risk and closer time zone alignment. In North America, 80% of chief operating officers report plans to increase nearshoring or onshoring in the next three years, a marked acceleration from 63% in 2022.

Five Defining IT Outsourcing Trends for 2026 and Beyond

1. Artificial Intelligence and Automation as Foundational services

Artificial intelligence is no longer a standalone service offering; it has become a foundation across all IT outsourcing work. Generative AI tools, machine learning model development, and AI operations (AIOps) are now standard capabilities expected of any credible outsourcing partner. AI integration represents one of the most transformative IT outsourcing trends.

The business case is clear: developers using GitHub Copilot (an AI pair programming assistant) complete tasks 55.8% faster than those working without AI assistance, according to a controlled trial conducted by Microsoft Research, GitHub, and MIT.

The implications cascade through outsourcing economics. When developers are 55% more productive, projects deliver faster, iteration cycles accelerate, and time to market shrinks. For enterprises, this means more innovation per dollar spent on outsourced development.

For outsourcing providers, it means higher margin per developer if they can harness AI effectively. The constraint, however, is AI expertise scarcity: data scientists, ML engineers, and prompt engineers command premium salaries.

This creates a virtuous cycle: enterprises outsource AI work to providers with deep AI talent pools (concentrated in hubs like India, Vietnam, and Eastern Europe), which then attracts further investment in AI capability building.

Beyond code generation, the most rapidly growing AI outsourcing services include ML model development (predictive analytics, recommendation engines, computer vision), data annotation and training data curation (critical for model quality), and AI operations management (deploying, monitoring, and retraining models in production).

Enterprises increasingly demand outcome focused AI projects: not laboratory experiments with interesting results, but AI systems that drive measurable business impact (fraud detection, demand forecasting, supply chain optimization).

2. Cloud Native Architecture and Multi Cloud Optimization

Cloud adoption has transitioned from migration project to operating principle. Approximately 75% of organizations are targeting cloud first digital transformation models by 2026, according to Gartner.

This shift has created enormous demand for cloud infrastructure outsourcing. The global cloud infrastructure services market reached $330 billion in 2024, up significantly from $270 billion in 2023. Cloud expertise has become one of the most sought-after IT outsourcing trends.

Beyond basic cloud hosting, enterprises now require sophisticated managed cloud services: multi cloud orchestration, serverless architecture design, containerization (Kubernetes), and cost optimization through cloud rightsizing.

Why the surge? Most enterprises do not operate on a single cloud. 89% of organizations have adopted multi cloud strategies, selecting AWS for compute intensive workloads, Azure for enterprise integration, Google Cloud for data analytics, and specialized platforms for niche needs.

This complexity demands specialized expertise: cloud architects who understand trade offs between platforms, security teams that can implement consistent governance across clouds, and DevOps engineers skilled in infrastructure as code and CI/CD pipelines. These roles are difficult to staff internally, making outsourced cloud expertise one of the fastest-growing trends.

The outsourcing opportunity spans the entire cloud lifecycle: assessment and strategy (identifying which workloads to move and to which cloud), migration execution, cost optimization (identifying and eliminating waste across cloud spending), and ongoing managed services (24/7 monitoring, patching, compliance).

Cloud migration services alone are projected to reach $75 billion by 2032, up from $11 billion in 2024, at a 24.9% CAGR, indicating that cloud to cloud migrations and cloud expansion will dominate IT outsourcing trends for the next five years.

3. Cybersecurity and Zero Trust Framework Maturation

Cybersecurity has become the most non-negotiable outsourcing function. 75 to 80% of large enterprises are planning to outsource security functions to specialized providers, driven by escalating threats (ransomware, credential theft, supply chain breaches, cloud misconfigurations), regulatory requirements (GDPR, HIPAA, and other data protection laws), and the impossibility of staffing a round the clock internal Security Operations Center (SOC) with in house talent.

The cybersecurity market itself is booming: valued at approximately $271.88 billion in 2025, it is projected to reach $663.24 billion by 2033, growing at an 11.9% CAGR.

Within this market, managed security services are growing fastest, particularly Managed Detection and Response (MDR), which provides 24/7 threat monitoring, investigation, and response without the operational burden of building an internal SOC. MDR services exemplify current IT outsourcing trends in security.

MDR combines advanced threat detection technology with human led expertise: security analysts who hunt for threats, validate suspicious activity, and orchestrate response actions in real time. For most mid sized and large organizations, MDR has become table stakes security infrastructure.

Beyond MDR, the outsourcing demand extends to advanced capabilities: penetration testing and red teaming, compliance management (GDPR, HIPAA, SOC 2, ISO 27001 audits), secure software development (code review, static analysis, application security testing), and incident response.

Organizations are also increasingly adopting zero trust security frameworks (the principle that no user, device, or system should be trusted by default, regardless of location), which requires continuous verification and monitoring, perfectly suited to outsourced managed security providers with economies of scale.

4. Intelligent Process Automation and Agentic AI

Robotic Process Automation (RPA) has matured from a niche automation tool to a mainstream enterprise capability. The global RPA market was valued at $3.79 billion in 2024 and is projected to reach $30.85 billion by 2030, growing at an explosive 43.9% CAGR.

The primary use cases remain focused on repetitive, rule based tasks: invoice processing, benefits administration, expense approvals, data entry, and document processing. RPA eliminates manual work, reduces errors, and frees human workers to focus on higher value tasks.

Emerging alongside RPA is agentic AI: systems capable of autonomous decision making within pre defined guardrails. Unlike simple RPA bots that follow rigid scripts, agentic AI can evaluate scenarios, make judgments, and adapt behavior based on context.

For example, an agentic AI system might automatically prioritize customer support tickets, escalate complex cases, and resolve routine inquiries without human intervention. The enterprise value is significant: faster resolution times, lower operational costs, and improved customer satisfaction.

However, agentic AI requires robust data foundations, transparent decision logic (explainability), and careful governance to prevent unintended consequences.

Complementing both RPA and agentic AI is the rapid adoption of low code and no code (LCNC) platforms. By 2026, 70% of new enterprise applications will be built using low code or no code technologies, up from just 25% in 2020.

These platforms democratize application development, allowing business users (citizen developers) to build workflows and applications without traditional coding. Market projections suggest the LCNC market will reach $45.5 billion by 2025 and exceed $100 billion by 2030.

For outsourcing vendors, this creates a new service model: instead of building custom code for clients, vendors help clients adopt LCNC platforms, migrate legacy processes into low code architectures, and embed automation into business workflows. This shift exemplifies evolving IT outsourcing trends.

41% of businesses are already running citizen development initiatives, meaning the outsourcing vendor’s role is shifting from builder to enabler.

5. Nearshoring, Regionalization, and Supply Chain Resilience

The outsourcing geography is shifting. While India, China, and the Philippines remain dominant (representing the largest absolute volumes of outsourced work), nearshoring has accelerated dramatically. Geographic diversification defines contemporary IT outsourcing trends.

In North America, 80% of COOs are actively considering or planning nearshoring, and Latin America has emerged as the fastest growing region for IT services delivery globally, with nearshore technology services projected at $17.9 billion in revenue in 2024.

Nearshoring offers a compelling value proposition: cost savings closer to 40 to 50% (compared to domestic hiring) without the coordination challenges of far offshore arrangements. Time zone overlap makes daily stand ups and synchronous collaboration seamless.

Regulatory proximity (nearshore providers in Mexico and Central America understand North American compliance frameworks, while Eastern European providers understand EU regulations) reduces risk. Furthermore, geopolitical diversification, not relying solely on a single offshore hub, insulates enterprises from trade tensions, visa restrictions, or political instability in any single country.

Beyond nearshoring, blended sourcing models are now standard: enterprises mix onshore senior architects, nearshore development and QA teams, and offshore specialists (where cost to quality ratio is optimal).

This geographic distribution is enabled by mature remote collaboration tools, cloud based development environments, and the normalization of distributed work post pandemic.

For the sourcing industry, this trend has driven increased investment in regional centers: Vietnam is expanding capacity; Eastern Europe (Poland, Ukraine) is attracting North American and Western European clients; and Latin America is capturing US and Canadian business.

The result is a more decentralized, resilient global outsourcing ecosystem compared to the India centric model of the 2010s.

Asia Pacific’s Outsourcing Ecosystem and Vietnam’s Emergence

Asia Pacific remains the undisputed powerhouse of global IT outsourcing, projected to grow at 11% CAGR through 2030, the fastest growth rate of any region.

India continues to lead by volume. Its massive English speaking workforce (over 5 million software developers), decades of outsourcing expertise, and established relationships with Fortune 500 companies make it the default choice for scale.

However, India is increasingly moving upmarket: TCS, Infosys, Wipro, and others are shifting from staff augmentation toward managed services, cloud consulting, and AI driven transformation projects.

China offers enormous technical depth and manufacturing scale capacity, particularly in hardware, semiconductors, and IoT. Global firms increasingly tap Chinese teams for specialized expertise in these domains, though data security and geopolitical concerns limit broader adoption.

The Philippines has carved out strength in business process outsourcing and customer service, with a strong and growing IT workforce. English proficiency is high, making it attractive for customer facing roles.

Vietnam has emerged as one of Asia’s fastest rising outsourcing destinations, combining several distinctive advantages that position it at the forefront of IT outsourcing trends:

Talent Pipeline and Cost Efficiency

Vietnam produces approximately 50,000 IT graduates annually from 153 accredited IT institutions, feeding an expanding IT workforce of 500,000+ engineers. Notably, Vietnam placed 19th in the International Collegiate Programming Contest (ICPC) worldwide, outperforming countries like Germany and India, demonstrating technical excellence beyond mere volume.

Despite this quality, salaries remain 40 to 50% lower than established outsourcing hubs and significantly lower than developed markets, providing exceptional cost to quality value.

Global Credibility and Provider Maturity

Vietnam’s ICT sector generated approximately $166 billion in revenue in 2024, a 13.2% increase from 2023, and contributes over 12% of national GDP. Overseas service exports hit $11.5 billion in 2024, representing a 54% increase from 2023, signaling accelerating global demand.

Critically, Vietnam is now ranked 7th worldwide for software outsourcing service exports, placing it among the true tier one outsourcing destinations.

Value Chain Migration

Vietnam’s largest IT outsourcer, FPT Software, exemplifies the sector’s maturation. With over $1 billion in annual overseas revenue, FPT has shifted its service mix: approximately 50% of revenue now comes from digital transformation services (cloud, AI, data analytics) rather than staff augmentation alone, and the company targets $5 billion by 2030.

This upmarket migration signals that Vietnamese providers are no longer competing primarily on cost; they are delivering innovation and strategic value.

Global Tech Partnerships

Major global players are investing in Vietnam’s AI and technology capabilities. NVIDIA has partnered with Vietnam’s Ministry of Planning and Investment to establish AI research centers, accelerating knowledge transfer and positioning Vietnam as an AI innovation hub.

Major technology companies have opened strategic R&D facilities in Vietnam, treating the country as a center of innovation for advanced development rather than just a manufacturing base.

AWS, Microsoft Azure, and Google Cloud have expanded partnerships and data center presence in Vietnam, driving adoption of global best practices.

Government Support and Digital Infrastructure

Vietnam’s government is actively building the ecosystem. The National Digital Transformation Program (2020 to 2025) has digitalized over 55% of government services, creating a tech forward economy and generating demand for IT services.

A new AI strategy and AI law are rolling out by 2025, establishing clear governance frameworks and signaling long term commitment.

Infrastructure investments in high speed broadband (5G expansion), data centers, and green computing are advancing, making Vietnam a viable hosting and development destination for mission critical systems.

Sustainability and Governance Positioning

Reflecting broader global trends, Vietnam is positioning itself as a partner for “sustainability driven AI”: leveraging lower energy costs, efficient data center operations, and governance focused practices to deliver AI solutions responsibly.

This positioning differentiates Vietnam not just as a cost effective destination but as a values aligned partner for enterprises with ESG commitments.

Global Market Expansion

Vietnamese providers are expanding their global presence, opening offices in major technology hubs worldwide to directly serve enterprises. FPT Software, Viettel, and other leading providers now have multilingual business teams and are building strong relationships with Fortune 500 companies across North America, Europe, and Asia.

In summary, Vietnam combines the scale and cost efficiency of traditional offshore outsourcing with the technology maturity, government support, and global partnerships of a tier one destination. It is neither a low cost commodity provider nor a boutique specialist; it is a credible, comprehensive, innovation capable partner.

Making Outsourcing Decisions in 2026

Choosing an outsourcing partner in 2026 is more nuanced than in the past. Simple cost comparison is insufficient; enterprises must evaluate multi dimensional fit, informed by current IT outsourcing trends.

Define Your Transformation Objective First

Are you solving for talent gaps (hiring is too slow or too expensive), cost optimization (reducing IT operations budgets), innovation acceleration (bringing AI, cloud, or new digital capabilities to market quickly), or risk mitigation (moving security operations offshore to specialists with better 24/7 coverage)?

Each objective drives different partner selection criteria. A company seeking AI acceleration needs an innovation focused partner with deep ML expertise; a company optimizing cost needs a partner with proven process efficiency and scale.

Assess Multi Dimensional Fit

Beyond cost, evaluate technical depth (Does the provider have proven expertise in the specific technologies you need: Kubernetes, PyTorch, Azure, DevSecOps?). Evaluate process maturity (Does the provider practice Agile, DevOps, and MLOps? Are they CMMI certified or ISO 27001 certified?).

Evaluate governance strength (Can they demonstrate risk management, compliance practices, and incident response capabilities?). Evaluate cultural compatibility (Can you communicate effectively? Do working styles and values align?).

Consider Blended Delivery Models

The days of pure offshore engagement are waning. Design a model with onshore technical leadership (architects, product managers) for strategic direction, nearshore or mid shore development for execution (balancing cost and collaboration), and offshore specialists where cost to quality is optimal (e.g., data annotation, routine testing). Hybrid models align with contemporary IT outsourcing trends.

Shift to Outcome Based Contracts

Rather than paying for resources (headcount or hours), negotiate contracts based on measurable outcomes: deployment frequency, application availability, security incident resolution time, or cost savings achieved. Outcome-based models represent progressive IT outsourcing trends.

This alignment ensures the vendor’s success is your success. Include escalation clauses if performance dips and renewal incentives if targets are exceeded.

Vet for Sustainability Alignment

Increasingly, your partner’s ESG practices matter. Request carbon footprint reporting for projects (especially relevant for AI model training, which is compute intensive). Ask about diversity in hiring, talent development programs, and data protection practices. ESG considerations shape IT outsourcing trends.

If your enterprise has ESG commitments, your outsourcing partners should support them.

Plan for Scale and Evolution

Choose a partner capable of growing with you. Can they scale from a pilot team of 5 to a dedicated center of 50? Can they evolve as your technology stack evolves (from cloud migration to AI to agentic systems)? Scalability aligns with long-term IT outsourcing trends.

Long term partnerships reduce knowledge loss and vendor switching costs; short term engagements are riskier.

About HBLAB

HBLAB is a software development and IT outsourcing partner focused on helping organizations execute the 2026 outsourcing agenda, faster delivery, stronger governance, and practical AI adoption. With 10+ years of experience and a team of 630+ professionals, HBLAB supports product engineering and team augmentation for enterprises, SMEs, and fast growing teams that need predictable delivery at scale.

Quality and process maturity are built into how HBLAB delivers. HBLAB holds CMMI Level 3 certification, supporting consistent execution across complex programs, including modernization and long running managed delivery engagements.

For AI driven outsourcing, HBLAB has been building AI powered solutions since 2017 and can support initiatives such as LLM integration, agent architecture design, tool and API integration, retrieval augmented knowledge systems, and production monitoring strategies. HBLAB also invested in establishing an AI research lab collaboration with an AI institute to accelerate applied AI delivery and talent development.

HBLAB offers flexible engagement models including offshore, onsite, and dedicated teams, and positions its delivery as cost efficient, up to 30% lower than local rates in some markets.

👉 Looking for a partner to accelerate cloud modernization, AI delivery, or a scalable dedicated team model.

CONTACT US FOR A FREE CONSULTATION

Conclusion: The Outlook Beyond 2026

IT outsourcing is transitioning from cost mitigation to strategic partnership. By 2030, the market will exceed one trillion dollars, driven not by offshoring routine work but by enterprises and outsourcing providers collaborating to deliver innovation, scale, and competitive advantage in an AI driven economy.

The winners in this landscape will be enterprises that view outsourcing as a lever for transformation, not a temporary fix, and outsourcing providers that deliver not just execution but thought partnership, technical excellence, and sustainable value creation.

Vietnam, alongside other Asia Pacific hubs, is well positioned to capture an increasing share of this growth. The country combines scale (500,000+ engineers), cost efficiency (significantly lower than developed markets), innovation capability (AI research partnerships with NVIDIA, Google, Amazon), and government support (digital transformation and AI strategy initiatives).

For global enterprises seeking both cost efficiency and technological partnership, Vietnam represents a compelling option: a credible, mature, innovation capable partner within the dynamic Asia Pacific region.

The businesses that understand outsourcing as strategy, not compromise, will capture disproportionate value in 2026 and beyond by effectively leveraging IT outsourcing trends.

Frequently Asked Questions

What is the IT outsourcing market size in 2026?

The global IT outsourcing market is valued at approximately $638.65 billion in 2026, with alternative forecasts ranging from $587 billion to $661 billion. By 2030, projections converge around $750 to 1,200 billion, reflecting sustained double digit growth driven by AI, cloud migration, and cybersecurity demand.

How much can businesses save with outsourcing?

Organizations typically achieve 15 to 30% cost savings through IT outsourcing, though results vary. Helpdesk outsourcing shows the highest success rate (91%), while complex domains like application development and systems integration achieve 62 to 69% cost reduction success.

Total operational savings can reach 20 to 55% when including labor, infrastructure, and equipment costs. The key is proper governance; without it, cost savings targets are missed.

Which countries or regions are best for different services?

India dominates for scale, enterprise consulting, and overall IT services volume. Philippines excels in business process outsourcing and customer service. Eastern Europe (Poland, Ukraine) is preferred for software development and nearshoring to Western Europe.

Vietnam is rapidly growing for AI, cloud, and software development, particularly attractive for global clients seeking quality at competitive rates. Mexico and Central America are leading nearshore destinations for North American companies. The choice depends on your technology needs, time zone preferences, and regulatory requirements.

What should we look for in an AI outsourcing partner?

Prioritize:

(1) Proven AI/ML expertise (portfolio of delivered projects, team credentials in TensorFlow/PyTorch/LLMs).

(2) Data handling practices (can they work with sensitive data securely?).

(3) Outcome focus (are they results driven or labor hour focused?).

(4) Governance maturity (do they have MLOps practices, model monitoring, explainability frameworks?).

(5) Continuous learning culture (do they invest in team training on latest AI frameworks?).

Is nearshoring better than offshoring?

Neither is universally “better”; it depends on priorities. Nearshoring offers reduced time zone friction, easier travel/communication, lower geopolitical risk, and strong talent in your region (LATAM for US, Eastern Europe for EU). Costs are 40 to 50% lower than onshore.

Offshoring (India, Vietnam) offers even lower costs (50 to 70% savings), access to massive talent pools, and mature infrastructure. If time zone flexibility and communication ease are paramount, nearshore. If cost optimization is primary, offshore. Many enterprises blend both.

How do we ensure data security with offshore teams?

Implement:

(1) Contractual security requirements (ISO 27001, SOC 2 compliance).

(2) Data residency controls (ensure sensitive data doesn’t leave secure environments; use VPNs or private clouds).

(3) Access controls (zero trust principles, multi factor authentication, audit logging).

(4) Vendor assessment (security audits, background checks, reference calls with existing clients).

(5) Insurance and liability clauses (ensure vendor carries cybersecurity liability insurance). Most mature offshore providers operate within secure enclaves and can meet enterprise security standards.

What role does sustainability play in outsourcing decisions?

Increasingly critical. Enterprises with ESG commitments now evaluate vendors on: carbon footprint (especially for AI model training and data center operations), energy efficiency, renewable energy usage, diversity in hiring, talent development programs, and governance practices.

Vietnam’s positioning as a “sustainability driven AI” partner reflects this shift. Request carbon accounting from vendors and include sustainability metrics in your vendor scorecard.

How can enterprises maximize ROI from outsourcing partnerships?

Focus on strategic alignment rather than just cost reduction. Define clear objectives (innovation, talent access, or cost optimization), establish outcome based contracts with measurable KPIs, invest in strong governance and communication frameworks, and build long term partnerships that evolve with your technology needs.

Choose partners with proven expertise in your required technologies, strong process maturity (Agile, DevOps, MLOps), and cultural compatibility. The most successful outsourcing relationships treat vendors as strategic partners rather than transactional service providers.

– AI and Machine Learning Trends 2026: The Solid Basis for Enterprise Transformation

– Healthcare Software Development: 7 Powerful Trends Reshaping Global Care in 2025