Developing a blockchain made simple. Compare 3 proven methods: build from scratch, use Ethereum/Hyperledger platforms, or fork existing blockchains.

Background and Purpose of Blockchain Technology

The concept of blockchain technology emerged from decades of cryptographic research. In the early 1990s, computer scientists Stuart Haber and W. Scott Stornetta developed groundbreaking prototypes for securely timestamping digital documents, preventing backdating or alteration.

Later, in 1998, computer scientist Nick Szabo conceptualized “bit gold,” a decentralized digital currency that never reached implementation but foreshadowed Bitcoin’s architecture.

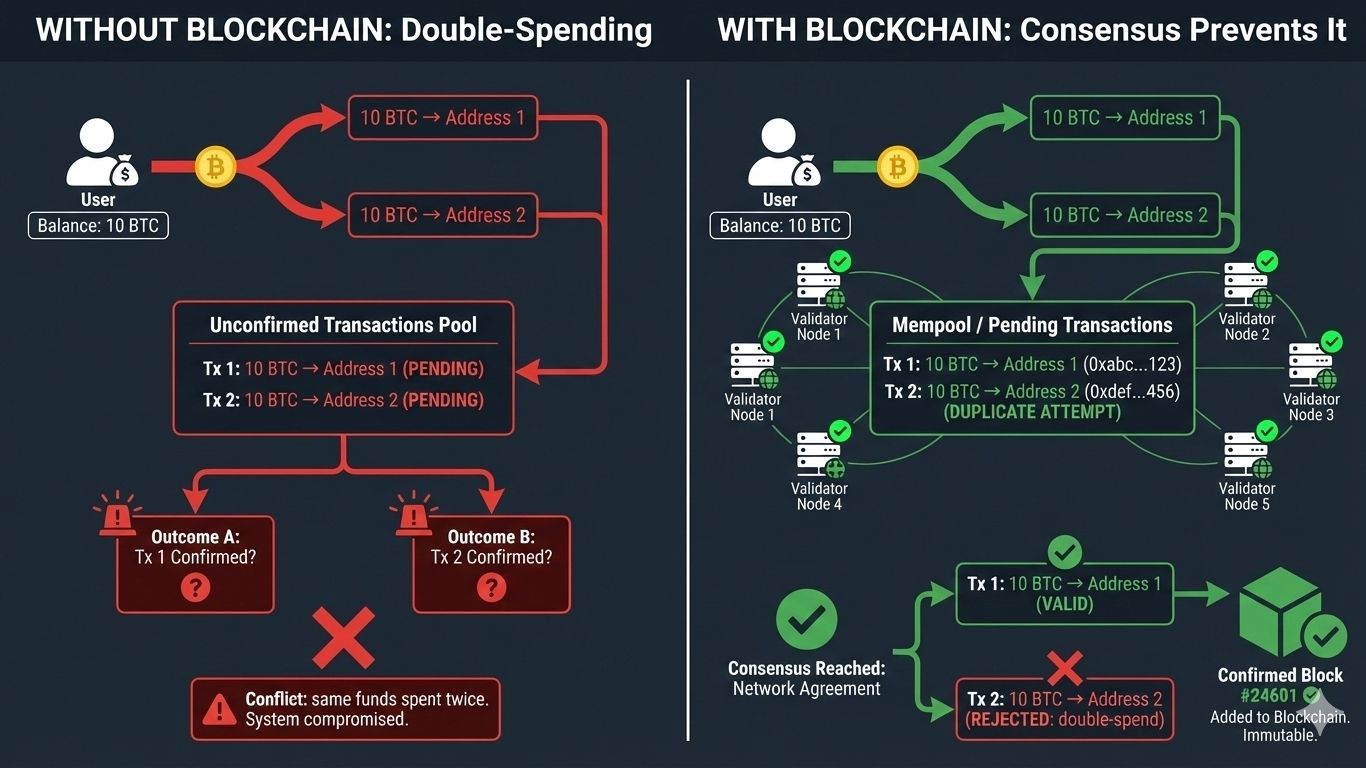

The technology existed in fragments for years until 2009, when an anonymous figure (or group) using the pseudonym Satoshi Nakamoto created Bitcoin, the first successful application of blockchain technology. Bitcoin solved a critical problem that had plagued digital currency for decades: the double-spending problem.

Unlike previous attempts at digital money, Bitcoin prevented users from spending the same digital currency twice without relying on a central authority.

Bitcoin emerged as a response to fundamental limitations in traditional centralized systems. These systems require a single entity (a bank, government, or corporation) to maintain records and validate transactions.

This centralized approach creates vulnerabilities:

- Single points of failure

- Susceptibility to hacking

- Potential for corruption

- Gatekeeping of financial access

By contrast, blockchain technology democratizes trust through decentralization, allowing peer-to-peer interactions without intermediaries.

What is Blockchain?

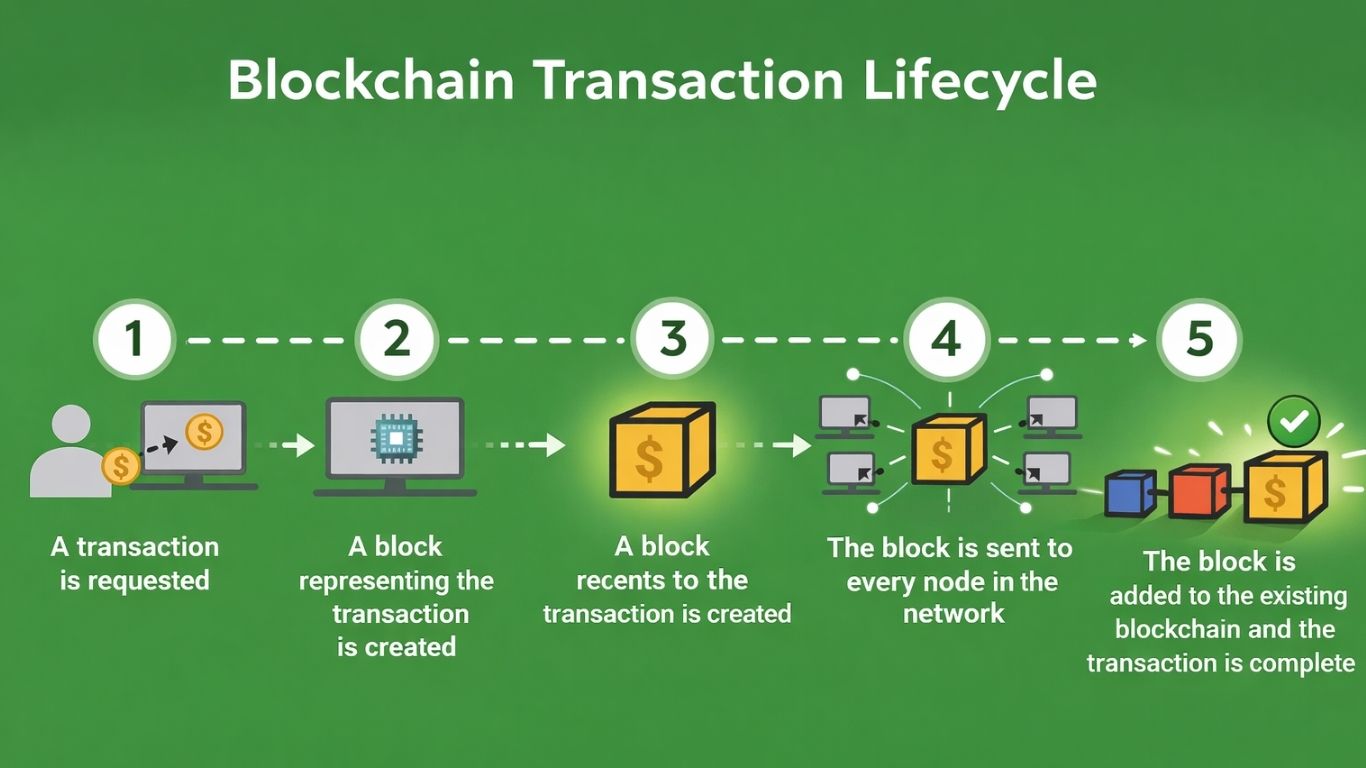

A blockchain is fundamentally a tamper-proof, shared digital ledger that records transactions in a decentralized peer-to-peer network.

Rather than storing data in a central location controlled by one entity, blockchain distributes identical copies of records across multiple computers (called nodes) worldwide. The permanent recording of transactions creates an immutable history of asset exchanges between network participants.

How Blockchain Works

Blockchain technology rests on three foundational pillars: decentralization, cryptography, and consensus mechanisms.

Decentralization eliminates the need for gatekeepers by distributing the ledger across many computers (nodes). Each node maintains a complete copy of the transaction history, ensuring that no single point of failure can compromise the entire system.

Instead of a central authority approving transactions, the distributed network reaches agreement through preset rules applied consistently across all nodes. This collective validation creates trust not through centralized authority, but through transparent, verifiable processes.

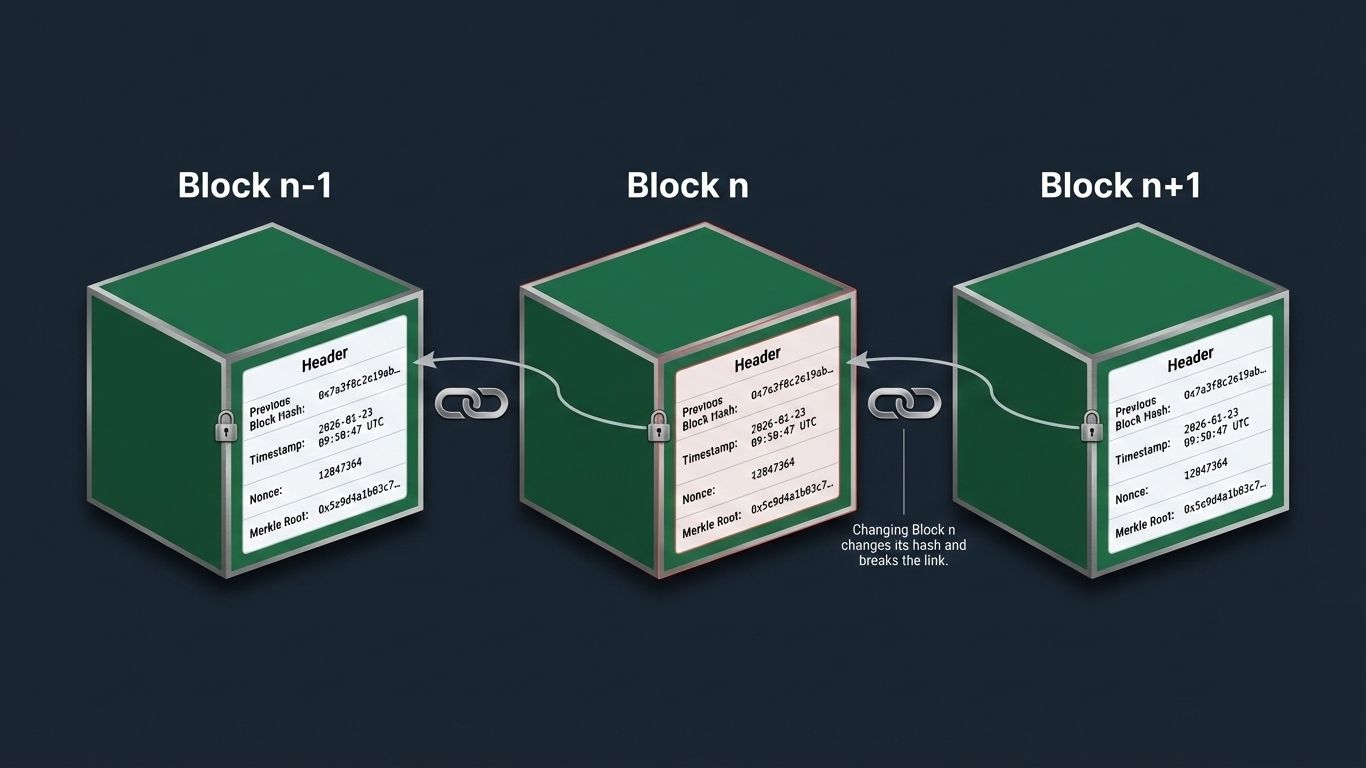

Cryptography protects the blockchain through complex mathematical algorithms that make data tampering extraordinarily difficult. Each block contains a cryptographic hash (a digital fingerprint unique to that block’s data).

Even a single-bit change in the data completely alters the hash, making any tampering immediately detectable. Digital signatures ensure that only the rightful owner of a private key can authorize transactions, similar to how a secret PIN controls a bank account.

Consensus mechanisms establish rules for how the network agrees on the validity of transactions. These mechanisms ensure that all participants maintain identical versions of the ledger without needing a central authority.

When a new transaction occurs, nodes verify it according to preset rules and add it only if consensus is reached.

Key Advantages Over Traditional Systems

Blockchain technology offers distinct advantages that make it valuable for specific applications:

- Direct peer-to-peer transactions without intermediaries, reducing costs and processing times

- Distributed architecture that eliminates single points of failure (even if thousands of nodes fail, the system continues operating)

- Immutable records that cannot be altered or deleted once recorded, ensuring data integrity critical for financial services and supply chains

- Censorship resistance since no single party controls the data flow

- Transparency that allows every network participant equal insight into transactions, fostering trust where it would otherwise be difficult to establish

Types of Blockchain

Blockchains are not monolithic. Different types serve different purposes based on who can participate and access the network.

Public blockchains remain open to anyone. Bitcoin and Ethereum exemplify this model. Anyone can join the network, validate transactions, and participate in consensus. Public blockchains sacrifice some performance for maximum decentralization and transparency.

Private blockchains restrict participation to invited members. Organizations use them for sensitive operations requiring privacy and control over participants. Private blockchains maintain the immutability and transparency benefits of blockchain while limiting network access to known, vetted parties.

Permissionless blockchains allow anyone to create an address and interact with the network without identity verification, eliminating gatekeepers. In contrast, permissioned blockchains designate which participants can validate transactions and access different parts of the network.

Consortium blockchains are used by organizations to enable private transactions among trusted participants spanning different corporate entities and geographical locations. The Enterprise Ethereum Alliance exemplifies this approach, bringing together over 450 businesses including Microsoft and Intel to develop blockchain solutions.

Hybrid blockchains combine elements of both private and public systems, allowing organizations to control who participates while maintaining transparency with regulators or the public. Hybrid models appeal to businesses requiring transaction privacy but needing to demonstrate compliance to external parties.

Blockchain Use Cases and Applications

Blockchain extends far beyond cryptocurrency. Its core properties (immutability, transparency, and decentralization) address real-world problems across industries.

Finance and Cryptocurrency

Bitcoin remains the most prominent application, enabling peer-to-peer payments without banks. Beyond Bitcoin, blockchain powers decentralized finance (DeFi) platforms that offer lending, borrowing, and trading without traditional intermediaries.

These applications democratize financial access for the 1.7 billion people worldwide lacking bank accounts.

Supply Chain Management

Blockchain creates tamper-proof, immutable ledgers tracking products from origin to consumer. This transparency combats counterfeiting, which is critical in pharmaceutical and luxury goods industries.

Smart contracts automate payments and quality control when predefined conditions are met, reducing paperwork and intermediaries. Companies like Walmart use Hyperledger Fabric to track food supply chains, ensuring rapid response to contamination.

Healthcare

Electronic health records stored on blockchain allow patients to control their medical data while ensuring secure, interoperable access for authorized providers.

Blockchain tracks pharmaceutical supply chains, preventing counterfeit drugs from reaching patients. Smart contracts automate insurance claims processing while maintaining patient privacy.

Voting and Governance

Blockchain enables secure, verifiable voting systems resistant to fraud and manipulation. Decentralized autonomous organizations (DAOs) use blockchain-based voting mechanisms for transparent, community-driven governance.

Intellectual Property

Creators timestamp their work on blockchain, creating indisputable proof of creation date. Smart contracts automate royalty payments when content is used, ensuring creators are fairly compensated without intermediaries.

How to Develop a Blockchain

Prerequisites for Developing a Blockchain

Before developing a blockchain, aspiring developers must build foundational knowledge across several areas.

Programming expertise forms the essential base. Proficiency in at least one major programming language is mandatory before specializing in blockchain development languages. Most blockchain developers begin with Python, JavaScript, or C++ before transitioning to blockchain-specific languages.

Cryptography understanding is non-negotiable when developing a blockchain. Developers must grasp:

- Hash functions (mathematical algorithms producing unique digital fingerprints from data)

- Digital signatures (proving transaction authenticity)

- Public-key cryptography (securing accounts and transactions)

This knowledge typically takes 3 to 6 months to internalize through dedicated study.

Data structures and algorithms are fundamental computer science topics underlying all software. Knowledge of linked lists (the conceptual basis of blockchain chains), queues, and graph theory helps developers understand how blockchain nodes communicate and maintain distributed ledgers.

Networking fundamentals are essential since blockchains are distributed systems. Developers must understand:

- Peer-to-peer networks where computers communicate directly without central servers

- The concept of nodes (computers running blockchain software)

- How information propagates across networks

Consensus mechanisms require understanding that blockchain networks must agree on the validity of transactions without a central authority. Each consensus type (Proof of Work, Proof of Stake, Proof of Authority) uses different approaches to reach agreement.

How Long Does It Take to Become a Blockchain Developer?

The timeline to becoming a blockchain developer varies significantly based on prior programming experience and dedication.

Entry-level positions typically require 6 to 12 months of intensive learning for those with programming backgrounds. Without prior programming experience, expect 1.5 to 2 years to develop baseline competency.

Breaking this into phases:

- Foundation-building phase (3 to 6 months): Covers blockchain fundamentals, cryptography basics, and general programming concepts

- Language specialization phase (2 to 3 months): Involves mastering Solidity (for Ethereum), Rust (for Solana), or other blockchain-specific languages

- Hands-on experience phase (6 to 12 months): Involves building real projects (this phase is crucial and cannot be rushed through online courses alone)

Job market data supports these timelines. With 3 to 5 hours of daily study, prospective developers can prepare for entry-level positions within 8 to 10 months.

However, mastery and specialization in developing blockchain platforms typically require 2+ years as blockchain technology evolves constantly.

Development Approach 1: Building a Blockchain from Scratch

Building a blockchain from scratch teaches the deepest understanding of how blockchain systems work. This approach requires 2 to 3 months minimum for a basic prototype, though production-grade blockchains take significantly longer.

Step 1: Create the Block Structure

The first step involves defining the block data structure (essentially what information each block stores). A basic block contains:

- A timestamp (when the block was created)

- Transaction data (the information stored in the block)

- A cryptographic hash of the current block (unique identifier)

- A reference to the previous block’s hash (creating the “chain”)

Popular blockchain programming languages include:

- Go (used by Hyperledger Fabric and Ethereum)

- Rust (used by Solana and Polkadot)

- Python (for prototyping)

- C++ (for high-performance implementations)

Go balances ease of learning with production-grade performance, making it excellent for beginners developing a blockchain.

Step 2: Implement Cryptographic Hashing

Hashing transforms block data into a fixed-size digital fingerprint. In Bitcoin and Ethereum, the SHA-256 algorithm creates a 256-bit hash.

Any tiny change in the data completely alters the hash, making tampering immediately obvious. This property creates the immutability that makes blockchain trustworthy.

Developers typically use existing cryptographic libraries rather than implementing hashing from scratch. Libraries like OpenSSL or built-in language functions provide tested, secure implementations.

Step 3: Build the Chain Mechanism

Blocks link together by storing each previous block’s hash. When validating the chain, nodes verify that each block’s “previous hash” reference matches the actual hash of the preceding block.

This creates an unbreakable chain: altering any historical block changes its hash, breaking the chain for all subsequent blocks.

The chain validation process is straightforward:

- Iterate through each block

- Calculate its hash

- Confirm it matches the stored hash

- Verify it references the previous block correctly

If any link fails validation, the block is rejected.

Step 4: Set Up Nodes and Network Communication

A blockchain without a network is just a database. Nodes must communicate to share blocks and transactions. This critical aspect requires implementing:

- Peer discovery: How nodes find each other on the network

- Block propagation: Broadcasting new blocks to all nodes

- Transaction broadcasting: Sending transactions to the network

- Synchronization: Ensuring all nodes maintain identical ledgers

Modern blockchains use peer-to-peer protocols that allow nodes to operate without central servers. Libraries like libp2p abstract away networking complexity, allowing developers to focus on blockchain logic.

Step 5: Implement Consensus

Consensus determines how the network agrees on which transactions are valid. The simplest approach for learning purposes is Proof of Authority, where designated validators approve blocks. This requires far less computational power than Proof of Work (PoW) or Proof of Stake (PoS).

In a basic PoW implementation, miners solve computationally difficult puzzles. The first to solve it gets to add the next block and receive cryptocurrency rewards. This computational work makes attacks expensive: to rewrite history, attackers would need to redo all the computational work faster than the honest network, which becomes economically infeasible as the network grows.

Proof of Stake requires validators to “stake” cryptocurrency as collateral. If they validate fraudulent transactions, their stake is forfeited. This economic penalty incentivizes honest behavior without requiring massive computational resources, making PoS more energy-efficient than PoW.

Step 6: Add Transaction Validation

Transactions must be validated before being added to blocks. This essential security layer ensures data integrity. Validation typically checks:

- Digital signature verification (proving the sender authorized the transaction)

- Sufficient sender balance

- Correct transaction format

- No double-spending

Development Approach 2: Using Existing Blockchain Platforms

Building from scratch takes months or years. Established platforms like Ethereum, Hyperledger Fabric, and Solana provide pre-built infrastructure, allowing developers to deploy blockchain-based applications in weeks instead of developing a blockchain independently from scratch.

Ethereum

Ethereum stands as the world’s leading smart contract platform.

Developers write smart contracts in Solidity (a programming language specifically designed for Ethereum) and deploy them to the global network.

Ethereum excels at:

- Decentralized applications (dApps)

- NFTs

- DeFi protocols

A major advantage is global network effects: thousands of existing applications can interact with your smart contracts without additional integration work, making it ideal for teams prioritizing speed over developing a custom blockchain.

However, Ethereum has limitations. Public Ethereum incurs “gas fees” (transaction costs paid to miners). During peak usage, these fees spike dramatically.

The network processes roughly 15 to 20 transactions per second, creating bottlenecks during periods of high demand.

Hyperledger Fabric

Hyperledger Fabric serves enterprises requiring privacy and control when developing blockchain solutions. Unlike public Ethereum, Fabric uses permissioned access: only approved organizations can join the network.

This enables confidential transactions between competitors (for example, supply chain partners who want transparency without exposing proprietary information to all parties). Fabric requires sophisticated infrastructure setup but offers unmatched customization for enterprise needs.

Fabric achieves 2000+ transactions per second, dramatically outperforming public Ethereum. It requires no native cryptocurrency for operations (transactions are validated by designated authority nodes rather than expensive mining).

Other Platforms

Other platforms include:

- Solana (optimized for high throughput and low latency)

- Polygon (Ethereum-compatible but faster and cheaper)

- Cardano (research-driven, proof-of-stake focused)

- EOS (user-friendly development experience)

Each platform offers tradeoffs in decentralization, throughput, and customization when evaluating options for developing blockchain applications.

When to Choose Platform-Based Development

Choose platform-based development over developing a blockchain from scratch when:

- Your application requires decentralized consensus across untrusted parties

- You need faster time-to-market than building from scratch permits

- You want to leverage existing liquidity and user bases (especially for DeFi and NFTs)

- You require features like smart contracts and atomic composability with other applications

- Your budget constraints make developing a full blockchain infeasible

Development Approach 3: Forking and Modification

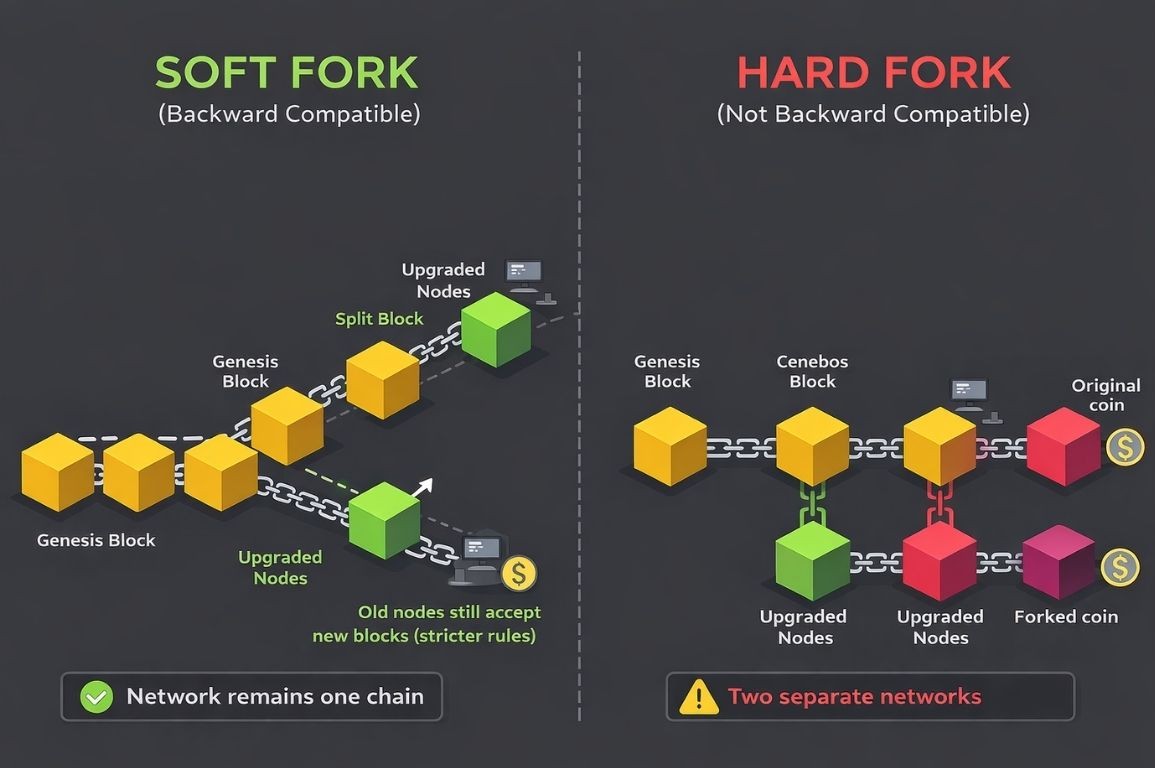

Since Bitcoin, Ethereum, and most major blockchains are open-source, developers can fork (copy and modify) their code to create custom blockchains. Forking represents a middle ground between the complexity of developing a blockchain from scratch and using an existing platform directly.

Soft forks are backward-compatible upgrades where new rules make previously-valid blocks invalid, but the network doesn’t split. The Bitcoin Taproot upgrade exemplifies soft fork (existing nodes can still operate with newer nodes).

Hard forks introduce non-backward-compatible changes, splitting the network into two separate blockchains with separate cryptocurrencies. Bitcoin Cash emerged from a 2017 hard fork when a portion of the Bitcoin community wanted larger block sizes to enable faster, cheaper transactions. All Bitcoin holders at the fork point received equivalent amounts of Bitcoin Cash.

Forking is 1.5 to 2 times faster than developing a blockchain completely from scratch because the foundational architecture is already proven. However, forking still requires significant expertise in understanding the codebase and making modifications without introducing security vulnerabilities.

Litecoin exemplifies successful forking. Created by modifying Bitcoin’s code, Litecoin uses faster block times (2.5 minutes vs. 10 for Bitcoin) and different hashing algorithms, but maintains Bitcoin’s core architecture. This approach was faster and less risky than developing a blockchain independently, yet allows Litecoin to serve different use cases than Bitcoin.

Partner with HBLAB for Expert Blockchain Development

Developing a blockchain requires more than technical knowledge. It can be facilitated with experienced teams who understand cryptography, distributed systems, and consensus mechanisms at scale.

Whether you’re building from scratch, leveraging platforms like Ethereum and Hyperledger Fabric, or forking existing solutions, HBLAB delivers the specialized talent and proven processes your blockchain project needs.

With over 700 IT professionals and a decade of experience in custom digital solutions, HBLAB brings deep technical capabilities across multiple blockchain tech stacks including Solidity, Rust, Go, and C++.

Our team includes 30% senior-level developers with 5+ years of hands-on experience in complex distributed systems and enterprise blockchain implementations.

Why choose HBLAB for blockchain development:

- Advanced technical expertise across all major blockchain platforms and consensus mechanisms

- CMMI Level 3 certification ensuring enterprise-grade quality and security standards critical for blockchain applications

- Strategic AI partnerships since 2017, enabling integration of cutting-edge technologies with blockchain solutions

- 30% cost efficiency compared to local rates without compromising on quality or development speed

- Flexible engagement models including dedicated teams, offshore support, and Build-Operate-Transfer (BOT) for complete project ownership

Our rigorous talent screening process ensures you work with developers who understand the nuances of cryptographic implementation, peer-to-peer networking, and smart contract security.

You maintain full control over workflows, tools, and product delivery while we handle the complexity of blockchain development.

Ready to accelerate your blockchain project?

People also ask

1. Can I build my own blockchain?

Yes, developing a blockchain is possible with standard software engineering skills plus distributed systems and cryptography basics. A simple educational chain can be built by defining a block structure, linking blocks with hashes, broadcasting blocks across nodes, and enforcing consensus rules so every node agrees on the same ledger state. Core concepts like nodes, hashing, digital signatures, and consensus are the foundation for developing a blockchain that other machines can verify independently.

2. Is $100 enough to start crypto?

If the goal is investing, $100 can be enough to buy a small amount of cryptocurrency on an exchange, but that is separate from developing a blockchain. If the goal is learning while developing a blockchain, $100 can cover basics like a domain, a small cloud server for testing, or transaction fees on a test deployment, but it will not cover professional security audits or a production launch.

3. How much does it cost to develop a blockchain?

The cost of developing a blockchain depends on whether you are building from scratch, forking, or using an existing platform, plus requirements for security, compliance, and infrastructure. For many teams, costs often start in the tens of thousands of dollars and can climb significantly for production systems with audits, monitoring, and long term maintenance. A permissioned business network may shift spend toward infrastructure and integration, while a public chain or token project often shifts spend toward security reviews and ecosystem tooling.

4. What are the 4 stages of blockchain?

A practical four stage way to describe blockchain evolution is: early cryptocurrencies, smart contracts, enterprise and industry adoption, then scaling and interoperability improvements. When developing a blockchain oriented product, the stage matters because it influences expectations around programmability, privacy, performance, and cross chain communication.

5. What are the 4 types of blockchain?

A common four type breakdown is public, private, consortium, and hybrid blockchains. This matters when developing a blockchain because it determines who can run nodes, who can read data, and how governance works in practice.

6. How much is 1 Bitcoin blockchain?

“1 Bitcoin” is a unit of the Bitcoin cryptocurrency, and its price changes constantly based on market trading, so the exact value must be checked on a live exchange or price index at the moment you are reading. Bitcoin is also an example that shows blockchain and Bitcoin are not the same thing, since Bitcoin is one application built on blockchain technology.

7. What if I put $1000 in Bitcoin 5 years ago?

The value today depends on the Bitcoin price exactly five years ago versus today, so it requires a date and historical price lookup to calculate precisely. The idea is still useful when developing a blockchain business case because it highlights volatility risk and why product decisions should not rely only on token price appreciation.

8. What is the biggest problem with blockchain?

The biggest real world problems tend to be tradeoffs, not a single flaw: scalability limits, governance complexity, and user security issues like key management. Consensus choice is a major factor because Proof of Work can be energy intensive, while other mechanisms trade decentralization, performance, or trust assumptions differently, which affects developing a blockchain that meets real requirements.

9. Can I withdraw money from blockchain to my bank account?

Blockchain itself is a ledger technology, not a bank, so moving value to a bank account usually requires a regulated bridge such as a crypto exchange or payment provider that supports bank transfers. If you are developing a blockchain product, plan for compliance steps like identity checks and banking partner requirements so users can off ramp to fiat smoothly.

10. Why can’t I cash out from blockchain?

Common reasons include missing identity verification, unsupported bank rails in your region, account holds for fraud prevention, withdrawal limits, or trying to withdraw an asset that is not supported for bank payout. If you are developing a blockchain app, clear UX around network fees, confirmation times, and custody versus self custody reduces cash out confusion.

11. Is blockchain real money?

Blockchain is a method of recording and verifying transactions, while “money” usually refers to currency issued by a government or widely accepted for payments. Cryptocurrencies like Bitcoin are digital assets recorded on a blockchain, but blockchain itself is not money, which is why developing a blockchain solution can be useful even without launching a coin.

12. Are any banks using blockchain?

Yes, banks and financial institutions have explored and deployed permissioned blockchain style systems for record keeping, settlements, and shared networks where participants are known and access is controlled. Permissioned and consortium models are specifically designed for organizations that want privacy and governance controls, which is often the direction banks take instead of public networks when developing a blockchain based system.

Read more:

– The Ultimate Guide to Successful Blockchain App Development

– Vietnam IT Outsourcing Company Insights: Market Landscape & Leading Providers

– Backend Development: The Complete Technical Authority Guide for 2026